piranka

Lear Corporation (NYSE:LEA) recently delivered impressive beneficial expectations about backlog increases and guidance for 2023, 2024, and 2025 driven by new product launches. In my view, the exposure to the electrification of cars all over the world, contracts with large clients, and international revenue will likely make future revenue less volatile than other small competitors. The total amount of debt is not beneficial, but putting everything together, I believe that the stock is clearly undervalued.

Lear: Seating For Electric Vehicles Will Likely Increase From 2023

Lear Corporation is a global provider of automotive parts and technologies, primarily for developments in seating comfort in service of user experience.

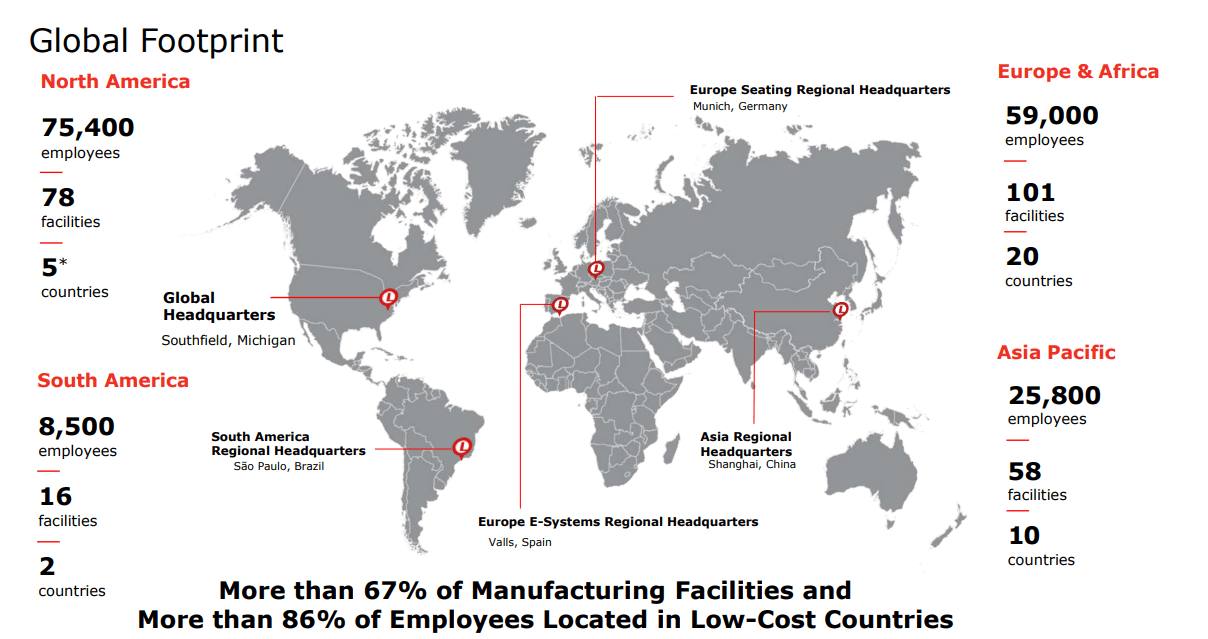

Among its products we find complete kits for seats and locks, complete battery systems and electrical connectivity, and other products that are marketed to some of the largest car manufacturers internationally. The company has 257 development, manufacturing, and distribution plants in more than 37 countries.

Source: Investor Presentation

The company’s operations are divided into two business segments: seating and electronic systems. Each of these has a wide variety of products in different ranges. The company permanently evaluates the new trends in international markets and the needs of its largest customers to adapt them in the design and development of its products.

The seats segment consists of the development, design, manufacture, sale, and distribution of complete car seat equipment. This segment is aimed at being able to meet a large amount of demand without losing quality or improvement levels in relation to previous products. These developments include comfort, thermal, beauty, and safety conditions, and can be adapted to both electric cars and cars with traditional fuel systems. In the same way, they are developed accompanied by software technology, algorithms, and data analysis that facilitate the insertion of ventilation or massage systems.

The electrical systems segment also consists of the development, design, manufacture, and distribution of complete automotive power systems, battery units, and other electronic components. Like the other segment, these developments are aimed at both electric cars and traditional combustion cars and cars with hybrid systems between both models. The products in this segment are also accompanied by system control, analysis, and management software, which are usually purchased by their customers together with the electrical system itself.

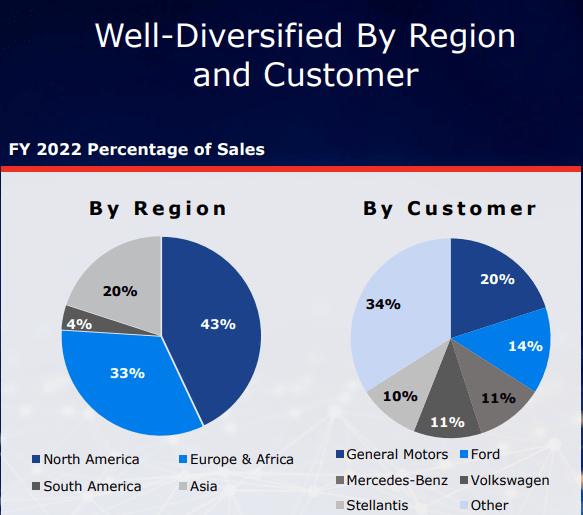

Currently, Lear Corporation has its products in more than 450 international brand vehicles. I believe that the business model of Lear is quite diversified.

Source: Investor Presentation

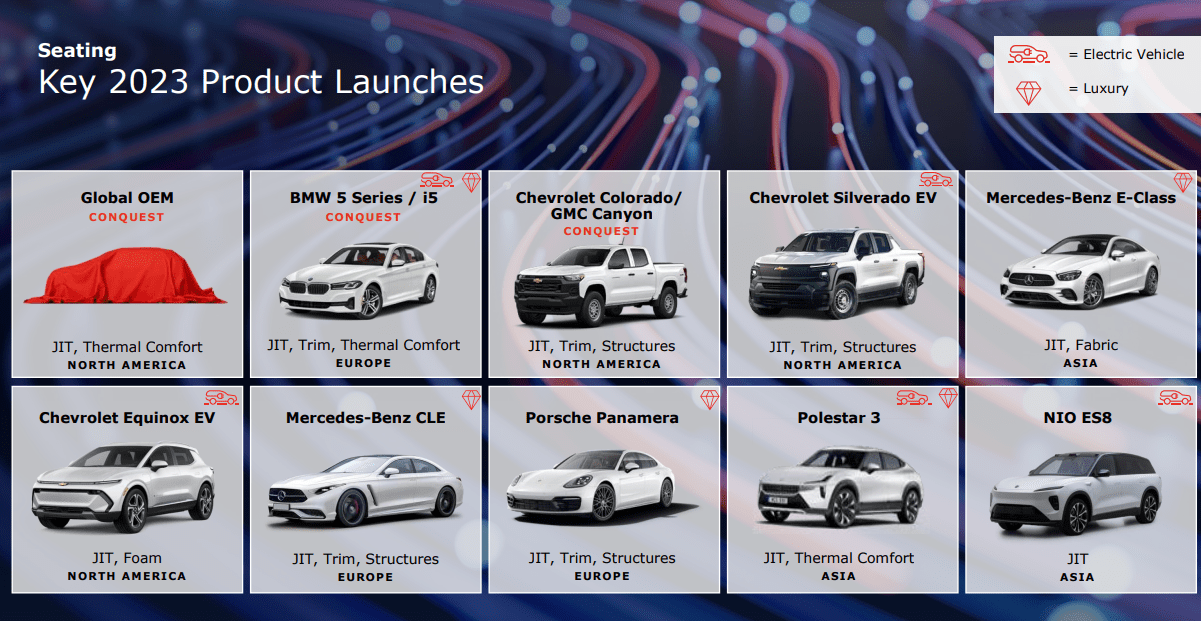

Considering the total number of key 2023 product launches, I believe that researching Lear right now is a great idea. Management expects to deliver a significant number of seating for electric vehicles, which may increase future sales growth. I assumed that the revenue for electric vehicles will likely grow at a larger pace than that of traditional cars.

Source: Investor Presentation

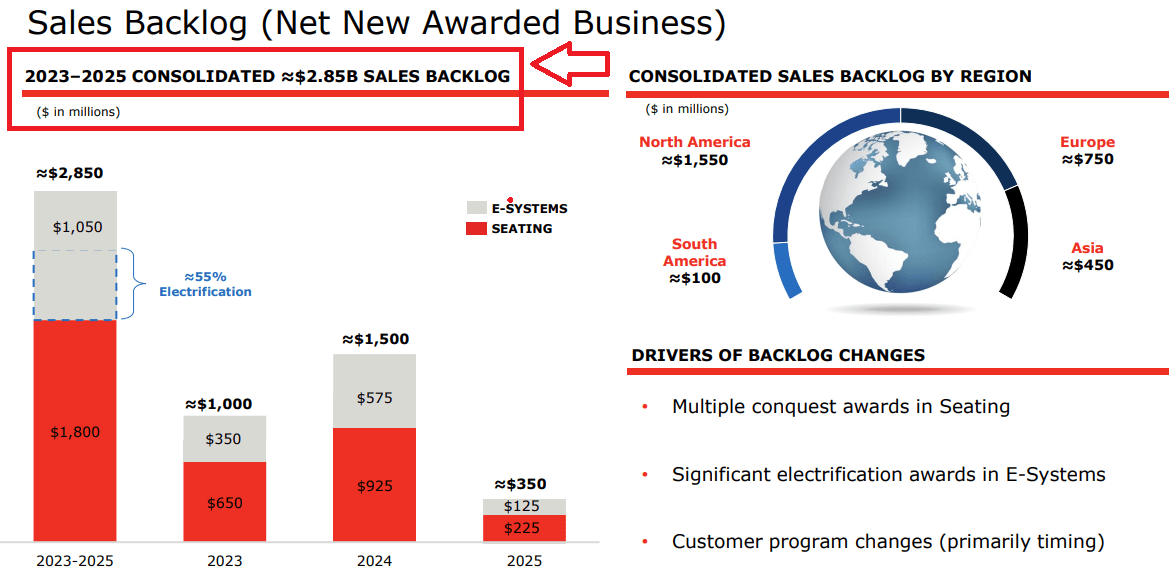

Sales Backlog And Market Expectations

Lear also delivered impressive sales backlog expectations for 2023-2025 driven by significant electrification awards in E-systems and growth in North America, Europe, South America, and Asia. In this regard, I believe that the following slide is quite relevant.

Source: Investor Presentation

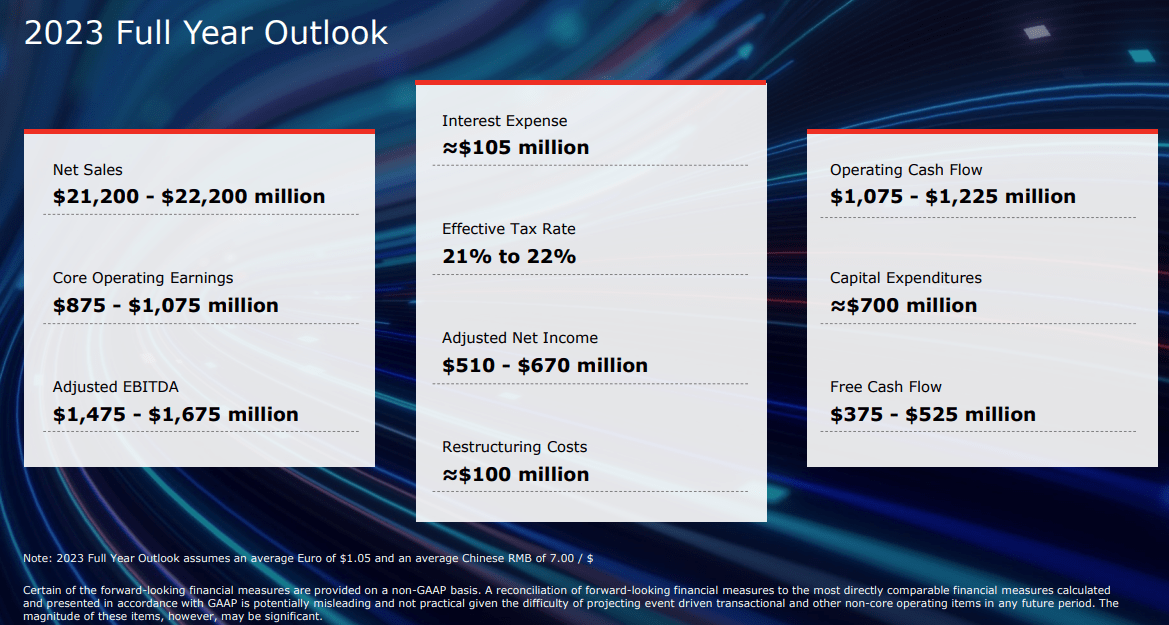

Management also reported optimistic guidance for the full year 2023, including effective tax rate close to 22%, FCF of $375-$525 million, restructuring costs close to $100 million, and capex of $700 million. I tried to use these figures in my DCF model, so investors may want to have a look.

Source: Investor Presentation

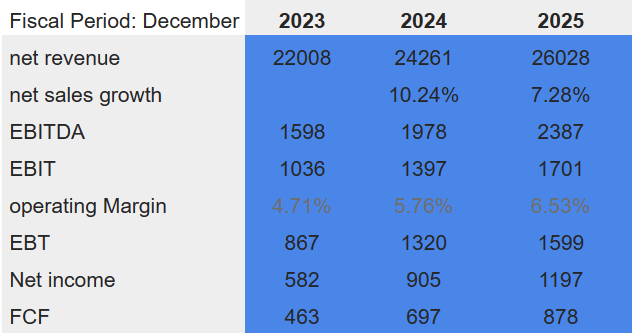

Market expectations for the years 2023, 2024, and 2025 seem quite beneficial. Analysts expect 2025 net revenue of $26.028 billion with net sales growth of 7.2%, 2025 EBITDA of $2.387 billion, 2025 EBIT of $1.701 billion, 2025 net income of $1.197 billion, and free cash flow of $878 million.

Source: S&P

Balance Sheet

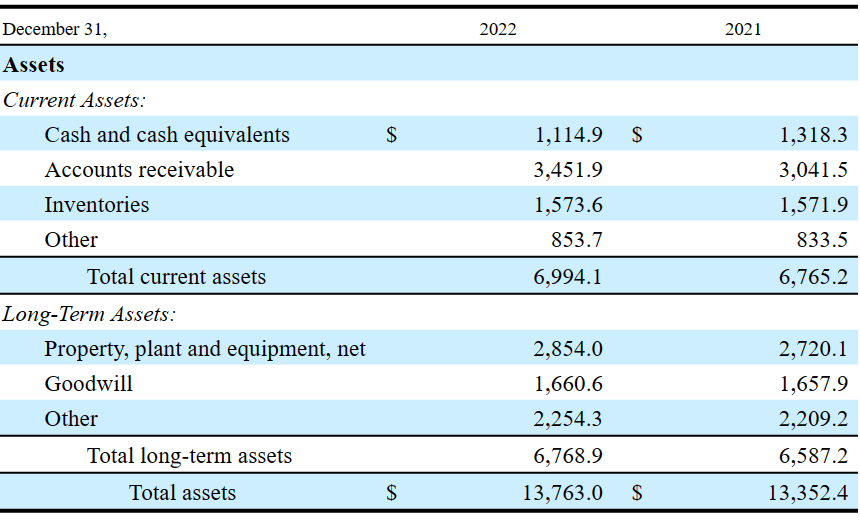

As of December 31, 2022, the company reported cash and cash equivalents worth $18 per share, accounts receivable close to $58 per share, with inventories of $26 per share, and total current assets per share of $118. Considering these figures and the current stock price, I believe that LEAR appears undervalued.

Long-term assets included property, plant and equipment of $48 per share, goodwill per share of $28, and total long-term assets per share worth $114.

Source: 10-k

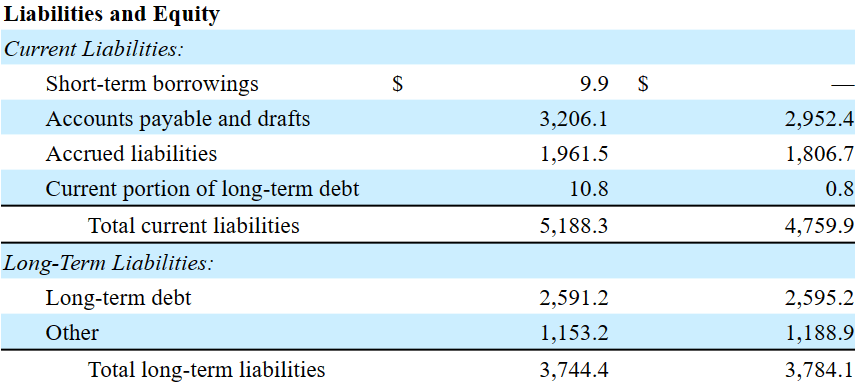

Current Liabilities included short-term borrowings worth $9.9 million, accounts payable and drafts worth $3.206 billion, and accrued liabilities of 1.961 billion. Besides, the current portion of long-term debt stands at $10.8 million.

I believe that investors may not appreciate that the long-term debt stands at $2.591 billion, which does not seem small. The total amount of debt may explain why the company trades that undervalued.

Source: 10-k

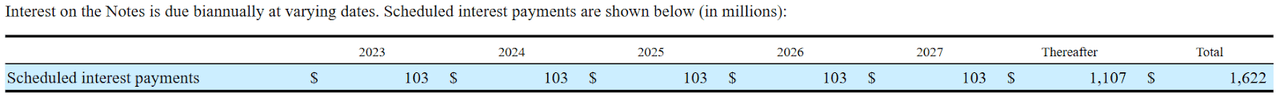

I am not concerned about the total amount of debt to be paid because most of its debt obligations may have to be paid around from the year 2027. I believe that management will most likely be able to renegotiate with debt holders, or reduce its debt obligations by 2027.

Source: 10-k

My Assumptions Include Enhancement Of Profit Margins, And Further Improvement Of Vehicle Architecture And Electrification

Under my DCF model, I included further enhancement of the profit margins, enhancement of the leading position in the light vehicle seating market, and transformation of the electronic systems segment through accelerated growth and further vehicle architecture and electrification. As a result, I believe that more clients will be interested in the product offering from Lear, and both sales growth and FCF will be delivered.

Besides, I assumed that Lear will successfully build a reputation as a brand of excellence through investments and developments in industry 4.0 as well as prioritization of the environment. In this case, I believe that more investors will have a look at Lear, which may lead to demand for the stock, lower cost of equity, and an increase in the fair value of the stock.

Finally, I assumed that the acquisitions made by Lear in 2022 and 2021 will successfully bring the expected synergies and technological advancements.

In February 2022, we completed the acquisition of substantially all of Kongsberg Automotive’s Interior Comfort Systems business unit, which specializes in thermal comfort solutions. With almost 50 years of experience in thermal comfort solutions, Kongsberg ICS has leading technology, a well-balanced customer portfolio built on longstanding relationships with leading premium automotive manufacturers, and an experienced team. Source: 10-k

In May 2022, we completed the acquisition of Thagora Technology SRL (« Thagora »), a privately held company based in Iasi, Romania, to access scalable smart-manufacturing technology. Source: 10-k

In May 2022, we entered into a definitive agreement to acquire I.G. Bauerhin (« IGB »), a privately held supplier of automotive seat heating, ventilation and active cooling, steering wheel heating, seat sensors and electronic control modules, headquartered in Gruendau, Germany. Source: 10-k

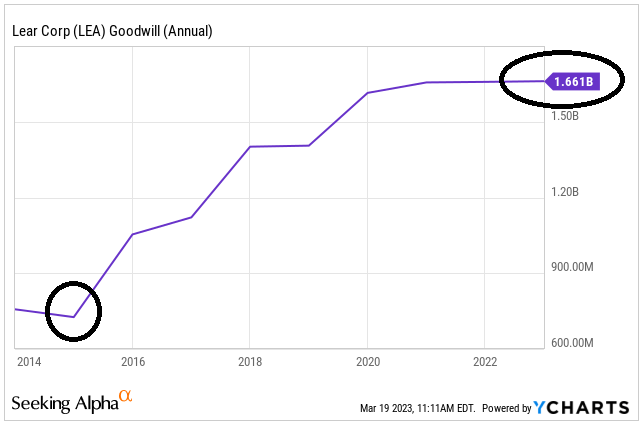

In my view, we need to keep in mind that Lear reported a significant goodwill increase from 2014. The number of acquisitions is simply quite impressive. I would expect the amount of inorganic growth to lower a bit because perhaps debt holders may not accept the acquisition proposals. With that, all these new teams working together will likely bring significant synergies, which may lead to FCF generation.

Source: Ycharts

Finally, under my financial model, I took into account that the restructuring currently developed by Lear will not damage the total production and design of new products. I believe that pretax restructuring costs do not seem that significant.

In 2022, we incurred pretax restructuring costs of $154 million and related manufacturing inefficiency charges of approximately $5 million, as compared to pretax restructuring costs of $101 million and related manufacturing inefficiency charges of approximately $12 million in 2021. None of the individual restructuring actions initiated in 2022 were material. Source: 10-k

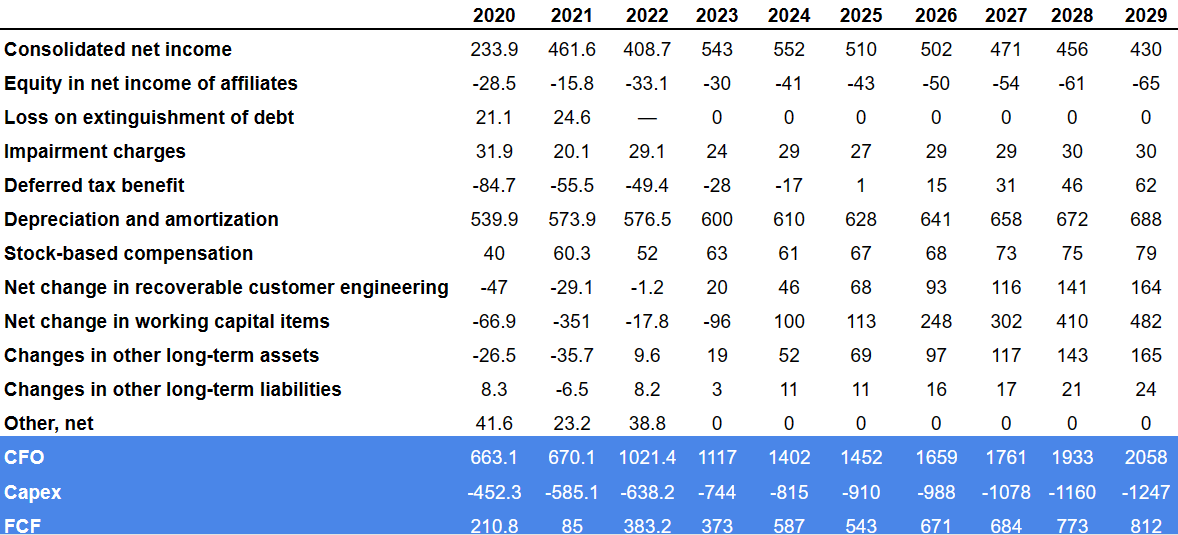

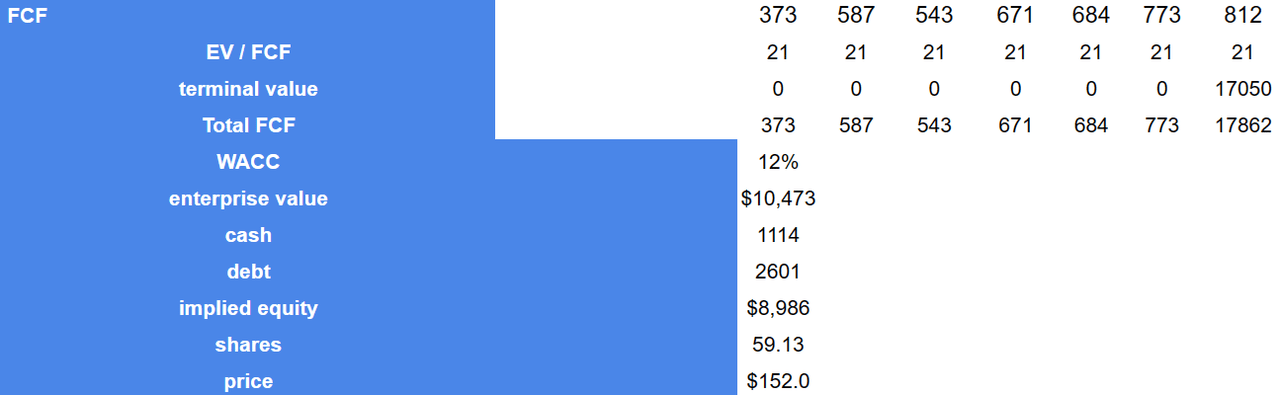

My financial model included 2029 net income of $430 million, adjustment for equity in net income of affiliates of -$65 million, deferred tax benefit close to $61 million, 2029 depreciation and amortization of $687 million, and stock-based compensation of $78 million.

I also believe that 2029 net change in recoverable customer engineering would be close to $164 million with net change in working capital of $482 million and 2029 changes in other long-term liabilities of $24 million. Finally, with 2029 capex of -$1.247 billion, 2029 FCF would be close to $812 million.

Source: My DCF Model

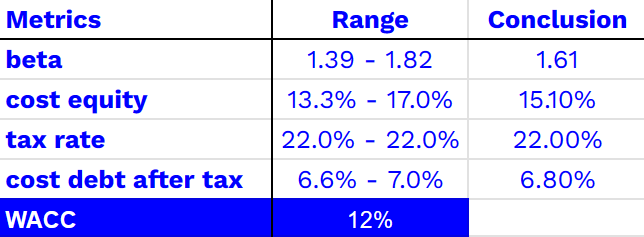

I used a WACC of 12% with a beta of 1.39-1.82, cost equity around 13.3%-17.0%, tax rate of 22%, and cost of debt after tax of 6.6%-7.0%. My CAPM model is close to the model reported by other investors out there.

Source: My DCF Model

If we assume an exit multiple of 21x, the terminal FCF would stand at close to $17 billion, and FCF would grow from $373 million in 2023 to around $773 million in 2028. The implied enterprise value would stand at $10.4 billion with cash of $1.11 billion, debt close to $2.6 billion, and an implied valuation close to $152 per share.

Source: My DCF Model

A Significant Number Of Competitors With Many Financial Resources

Competition for the company varies by operating segment. In the seating segment, its top five customers are General Motors (GM), Mercedes-Benz (OTCPK:MBGAF), Stellantis (STLA), Volkswagen (OTCPK:VWAGY), and Ford (F). Notable competitors are Adient plc (ADNT), Forvia, Magna International Inc. (MGA), Toyota Boshoku Corporation (OTCPK:TDBOF), TS TECH Co., Ltd. (OTC:TTCAF), and Yanfeng Automotive Systems Co., Ltd.

The electronic systems segment, on the other hand, has Ford, Renault-Nissan (OTCPK:RNSDF), and Jaguar Land Rover as its largest customers. The largest competitors in this segment are Aptiv PLC, (APTV), LEONI AG (OTCPK:LNNNF), Molex Incorporated, Sumitomo Corporation (OTCPK:SSUMF), TE Connectivity (TEL), Yazaki Corporation, Contemporary Amperex Technology Co. Limited, Delta Electronics, Inc. (OTCPK:DLEGF), LG Energy Systems, Ltd., and Yazaki Corporation.

Risks

Despite being a first-class company and providing services to the most recognized brands in the automobile market, Lear has certain operational, regulatory, and financial risks. In its operations, the dependence on the growth or rhythm of its clients will always be a limitation along with the risks of access to raw materials or possible effects from supply chain crises.

In terms of regulations, new trends towards reducing damage to the environment and future restrictions on vehicle traffic stand out, which would complicate the situation of clients although they would not directly affect Lear. If clients produce less, in my view, we could expect lower sales growth and FCF generation.

Finally, Lear reports a total amount of debt that could prevent the company from accessing the capital market and credit lines, and ultimately from developing or investing in new products. Besides, higher interest expenses could bring lower free cash flow, and may lower future expectations. As a result, we could expect lower stock valuations.

Considering the institutional investors holding shares, I believe that having a look at Lear is a great idea. Blackrock reports close to 8.56 million shares and 14% of the total amount of shares outstanding. Pzena Investment Management Llc owns 6.86 million shares, and Vanguard notes close to 5.68 million shares.

With that about the funds holding shares, it is worth noting that some officers recently sold shares. The Chief Executive Officer reported a sale at price $138.50 per share, and the Treasurer reported a sale at price $141.44 per share. In my view, further sales reported by the CEO may bring a decline in demand for the stock.

Conclusion

Lear Corporation reports a significant amount of exposure to the new wave of electric cars in both business segments. It is also worth noting that international exposure and contracts with massive customers will likely limit revenue volatility in case of any type of worldwide crisis. Finally, backlog increases and guidance for 2023 appear to be great reasons for having a look at the future of Lear. Yes, I do dislike the total amount of debt, and the recent sale of stock from insiders is not ideal, but I believe that LEA stock is undervalued.