17 February 2023

Hans-Peter Annen, head of valuations and insights at Eurotax Switzerland (part of Autovista Group), analyses the performance of the Swiss automotive market.

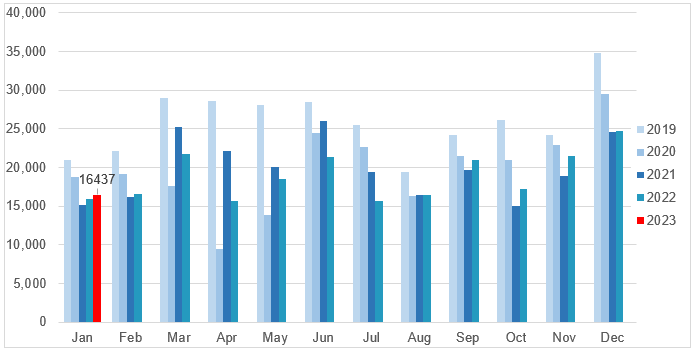

The positive trend in new-car registrations that began in autumn 2022 continued into January 2023. Last month’s figures are higher than the corresponding values for 2021 and 2022. Despite the war in Ukraine, inflation and energy fears, the improved supply situation probably contributed to this increase.

A total of 16,437 new passenger cars were registered last month, a 3.4% increase on January 2022, but still 21.5% down on pre-COVID 2019. The market share of electrified or all-electric powertrains is now 54.2%. Despite various uncertainties, a further slight recovery in new registrations can be expected in the coming months.

New-car registrations by month, 2019-2023

Upward trend broken

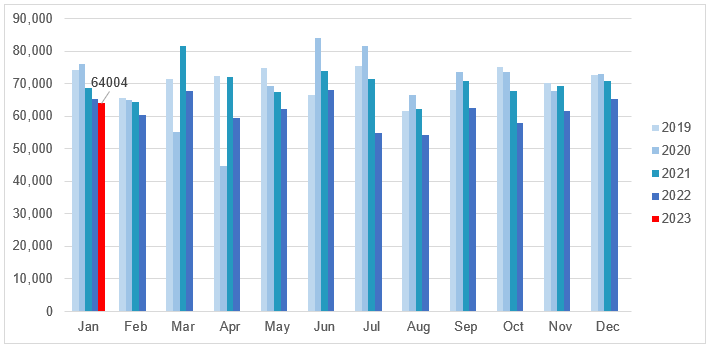

Since the summer of 2020, the used-car market has been characterised by high demand. For a long time, this was contrasted by very low supply, which has since increased markedly. Ownership changes in 2021 almost returned to pre-COVID-19 levels, then declined again in the first half of 2022 (according to the old counting method*).

Values in the second half of 2022 were clearly below the previous year. The change in ownership figures for January 2023 were also roughly 2% below the previous year. So, the upward trend was broken in 2022 and since then the figures have remained below pre-COVID values.

This trend towards declining changes of ownership is likely to continue in 2023 as long as new registrations remain low. Additionally, the new cars not sold between 2020 and 2022 will be permanently missing from the used car market.

Used-car transactions by month, 2019-2023

Varied recovery rate

The number of used cars on offer has recovered steadily in recent months and has almost reached the supply volume seen in February 2020. However, this recovery has varied greatly depending on age group. For example, the supply of used cars up to two years old was 17% lower than in February 2020 but was slightly higher in other age groups.

Due to stable demand and partially constrained supply, offer prices on the used-car market continued to rise in the first half of 2022, and only weakened slightly in the second half. Continued good demand is being met by a shortage of supply, especially for young used cars. As long as registrations remain lower than before the crisis years, the price level will also move downwards, just slowly.

Offer prices for all vehicles have benefited from the supply shortage since 2020, especially diesel and petrol vehicles to begin with. However, diesel lost ground since the autumn of 2022. Battery-electric vehicles (BEVs) were able to record particularly significant increases in the first half of 2022, although this trend has been broken. Younger electric models have benefited particularly. Among 12-month-old cars, BEVs take first place in terms of residual value (RV), with an average sales value of 83.3%, just ahead of hybrid vehicles.

* Note on the figures for 2022

Since the beginning of 2022, the Federal Roads Office, ASTRA, has provided figures for changes of ownership. Before that, up to and including June 2022, ASTRA supplied raw data with all changes in the Swiss vehicle stock. The analysis of changes of ownership was carried out by Eurotax, partly with assumptions. The figures calculated in this way were approximately 3% higher than the values according to ASTRA’s own evaluation from 2022 onwards. For this reason, the figures for 2022 are based on the ASTRA data. The values up to and including 2021 are shown according to the previous method. This must be taken into account when comparing the figures for 2022 with previous years. Comparisons are therefore only possible to a very limited extent, if at all.