rvlsoft

Introduction

General Motors (NYSE:GM) used to say they would have cumulative battery electric vehicle (« BEV ») production of 400,000 units in North America by the end of 2023. This has now been pushed back to mid-2024 and it is still a tall order. My thesis is that GM has their work cut out for them with respect to BEVs. They have to ramp up BEV production rapidly without cutting too severely into the EBIT from traditional vehicles.

The Numbers

A February 14th New York Times article reports that the EU has effectively banned the sales of vehicles powered with diesel or gasoline beginning in 2035. This follows similar legislation in California and New York so it isn’t surprising that GM has ambitious goals with respect to electric vehicles. The goals set about by GM will not be easy to meet unless things go perfectly – unexpected developments could easily push things back.

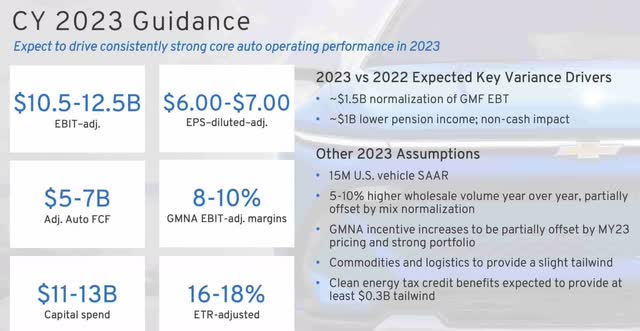

In the 4Q22 letter, CEO Mary Barra talked about the production of 400,000 BEVs in North America:

By leveraging U.S.-made battery cells produced by our Ultium Cells joint venture and the scalability and flexibility of the Ultium Platform, we are accelerating production of the Cadillac LYRIQ, GMC HUMMER EV and BrightDrop Zevo 600, and we will launch exciting vehicles like the Chevrolet Silverado EV, Blazer EV and Equinox EV. This keeps us on track to produce 400,000 EVs in North America from 2022 through the first half of next year.

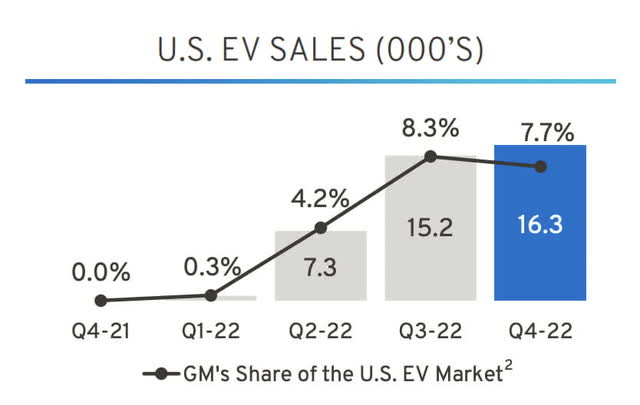

Looking at the 4Q22 earnings deck, we see less than 40,000 BEVs sold in the US during 2022:

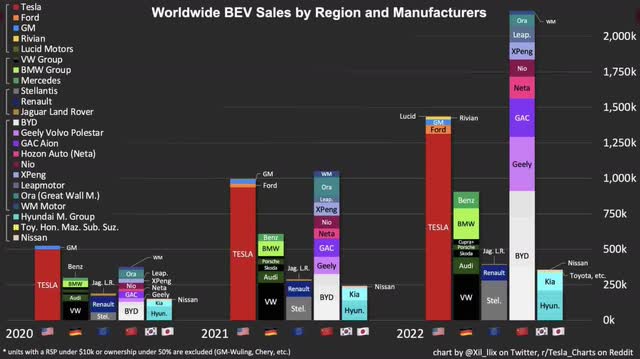

In order for GM to produce and sell about 360,000 more BEVs in North America by mid-2024, I’m thinking maybe they can produce about 200,000 in 2023 and another 160,000 in the first half of 2024. This will be challenging but we saw Geely (OTCPK:GELYY) grow rapidly in 2022 so it is possible. A Geely December 2022 release shows that 2022 was a banner year as they jumped from sales of 61,327 BEVs in 2021 all the way up to sales of 262,253 BEVs in 2022. Looking at worldwide BEV sales, we see that not many manufacturers have been capable of this type of explosive growth:

It isn’t just the milestone of reaching 400,000 cumulative BEVs in North America by mid-2024 that will be challenging. The 2022 10-K says GM plans to rapidly scale capacity to build 1 million EVs in North America and 2 million worldwide by the end of 2025:

We plan to rapidly scale our capacity to build one million EVs in North America and more than two million EVs globally by the end of 2025.

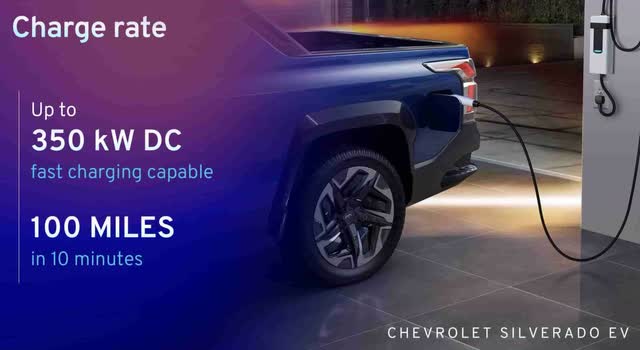

One factor that can help GM attract new buyers is fast charging. The 2022 Investor Day presentation by President Mark Reuss caught my eye when it was revealed that the Chevy Silverado EV has a charge rate of up to 100 miles in 10 minutes:

Fast charging (2022 Investor Day)

Ford (F) recently showed that it isn’t easy building large numbers of new types of vehicles. A February 15th CBS News article revealed that production is being paused on the F-150 Lightning BEV due to a battery problem. GM’s 2022 10-K reveals had their own challenges with the Bolt:

In July 2021, we initiated a voluntary recall for certain 2017-2019 model year Chevrolet Bolt EVs due to the risk that two manufacturing defects present in the same battery cell could cause a high voltage battery fire in certain of these vehicles. Accordingly, in the three months ended June 30, 2021, we recorded a warranty accrual of $812 million. After further investigation into the manufacturing processes at our battery supplier, LG, and disassembling battery packs, we determined that the risk of battery cell defects was not confined to the initial recall population. As a result, in August 2021, we expanded the recall to include all 2017-2022 model year Chevrolet Bolt EV and Chevrolet Bolt Electric Utility Vehicles (EUVs) and recorded an additional warranty accrual of $1.2 billion in the three months ended September 30, 2021.

Valuation

A November 2022 WSJ article by Ryan Felton notes that GM’s Cruise efforts are progressing as they work with the California DMV to expand driverless testing. However, another November 2022 WSJ article by Tim Higgins describes how investors are getting impatient with driverless ambitions. The Charging Ahead book by David Welch talks about the fact that self-driving systems like GM’s Cruise are often slow and impractical:

The car was even more ponderous when we pulled up behind a food truck. Ten seconds went by and nothing. The car’s artificial eyes detected an oncoming car and waited another five seconds. Finally, after waiting twenty-six seconds in all, it crawled past the truck. Later in the ride, we entered a roundabout. In Europe, where roundabouts are de rigueur, people blast through so long as no cars are coming. The Bolt AV entered the roundabout and stopped. It pumped the brakes a couple of times before finally heading through. There had been no cars to avoid. Cruise’s system didn’t really do anything wrong. It was just slow and boring to ride, at its best, and ponderous and sloppy at its worst. And that’s the point Vogt told me afterward. « Comfort and smoothness of ride is a distant priority after making the vehicle safe, » Vogt said. « Over the company’s three-year history, only about 2 percent of the time have we considered any element of smoothness or comfort. It has been entirely about getting you there safely. »

[Kindle Location: 2,743]

GM’s Cruise segment still has negative EBIT and it’s hard to put a valuation range on this part of the company right now.

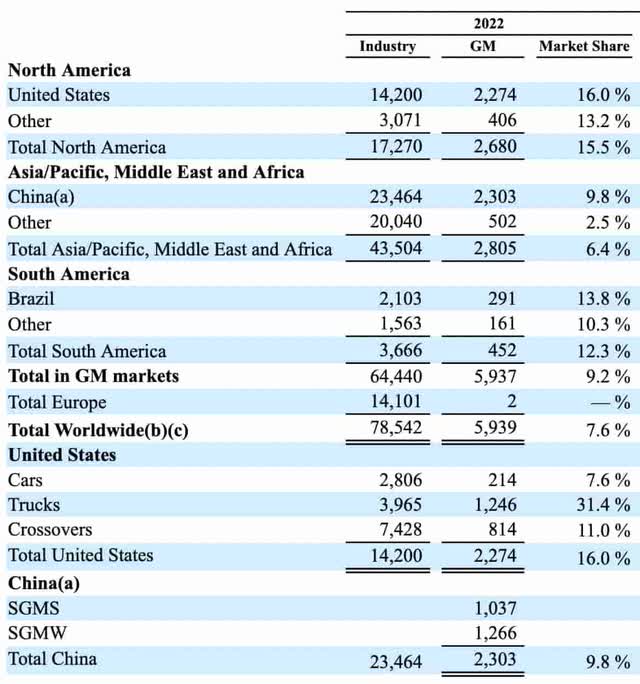

The 2022 10-K shows industry and GM vehicle sales by geographic region in thousands:

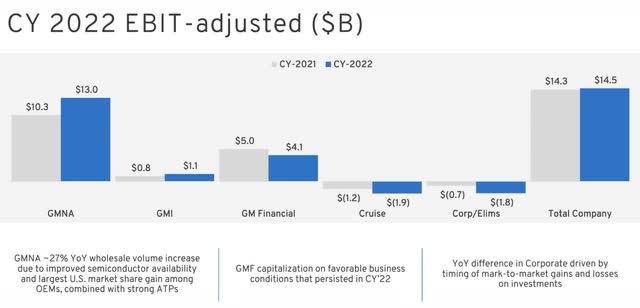

The [a] footnote for the table above reveals that the China numbers include sales by the Automotive China Joint Ventures: SAIC General Motors Sales Co., Ltd. (« SGMS ») and SAIC GM Wuling Automobile Co., Ltd. (« SGMW »). These unit numbers are not apples to apples with the unit numbers in the US as domestic sales drive a substantial majority of GM’s earnings. A Carscoops article says the Hong Guang MINI EV produced by GM and Wuling in China only sells for about $4,000 and the profit per vehicle is a mere $14. The 4Q22 earnings deck shows that most of GM’s overall EBIT for 2022 comes from the $13 billion in EBIT from GM North America (« GMNA »). GM International (« GMI ») only contributed $1.1 billion in EBIT for 2022. As such, much of GM’s valuation depends on domestic auto sales:

In addition to EBIT, I like to think about adjusted automotive free cash flow (« FCF ») in my valuation framework. The 2022 10-K defines adjusted automotive FCF as follows:

Adjusted Automotive Free Cash Flow We measure adjusted automotive free cash flow as automotive operating cash flow from operations less capital expenditures adjusted for management actions. For the year ended December 31, 2022, net automotive cash provided by operating activities under U.S. GAAP was $19.1 billion, capital expenditures were $9.0 billion and adjustments for management actions were $0.4 billion.

The 4Q22 earnings deck says adjusted automotive FCF for 2023 should be $5 to $7 billion:

I think a reasonable valuation range for GM stock is 10 to 12x the midpoint of 2023 adjusted automobile FCF which comes to $60 to $72 billion.

The 2022 10-K shows 1,394,637,226 shares outstanding as of January 17th. Multiplying this by the February 17th share price of $43.17 gives us a market cap of $60.2 billion.

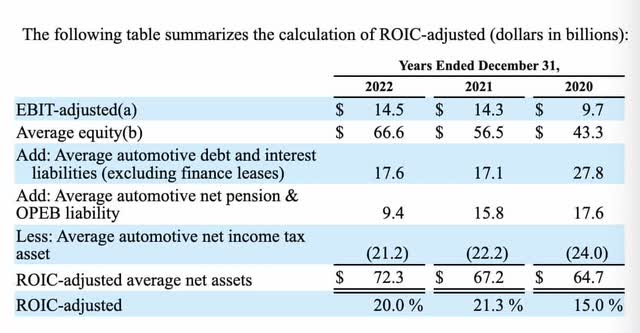

When looking at the capitalization beyond market cap, a May 2022 Seeking Alpha article reminds us that GM Financial debt is not part of the automotive enterprise value. Another factor that lets us treat GM Financial separately is the ROIC table:

Given the considerations above, I see the automotive enterprise value as $14,383 million more than the market cap due to $357 million Cruise noncontrolling interests plus $4,135 million general noncontrolling interests plus $4,193 postretirement liabilities plus $5,698 pension liabilities. The net automotive net debt consideration, tax deferral consideration and cash equivalent consideration are a bit nebulous to me.

The market cap is in line with my valuation range so I think the stock is reasonably valued.

Forward-looking investors should keep tabs on the Cruise Origin exemption petition. A February 14th article from Roads & Bridges says the review process is underway as the NHTSA seeks more answers regarding safety:

NHTSA officials are also seeking info about when the company will contact first responders or dispatch its own crews, adequate entry and exit systems that don’t impact fellow road users, and when vehicles decide to stop in the middle of the lane versus pulling over to the curb. The agency is also asking about an incident that happened last June in which 13 Cruise vehicles stopped on a street in San Francisco, and what technology is preventing this from happening again.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.