27 February 2023

In 2022, the volume of used-car transactions weakened more than new-car registrations in four of the big five European markets, explains Autovista24 senior data journalist Neil King.

The used-car markets of France, Germany, Italy, Spain, and the UK all contracted year on year in 2022. France and Germany endured the most pronounced declines and even the UK’s used-car market weakened more than its new-car market – despite expanding by 5.1% in the first quarter.

The exception was Italy, where new-car registrations contracted more than used-car transactions last year. Nevertheless, the big five European used-car markets averaged a 9.9% decline, which was more than double the 4.8% average downturn in the new-car markets – exactly as Autovista Group predicted.

Undersupply easing

Used-car markets continue to be hampered by poor supply stemming from new-car delivery delays but are showing signs of improvement despite the cost-of-living crisis. Official data for January reveal year-on-year growth in the volume of used-car transactions in Germany, Italy, and Spain. France bucked the growth trend last month but the 6.9% downturn was far less severe than the 13.5% contraction in full-year 2022.

However, new-car markets are expanding more quickly, except for Germany as lower incentives for electric vehicles (EVs) pulled registrations forward from January into the end of 2022. The easing of undersupply and current economic challenges would ordinarily have a negative impact on used-car demand and residual values (RVs). However, Autovista24’s latest Monthly Market Update (MMU) confirms that values of three-year-old used cars, represented as a retained percentage of their original list price (%RV), are being maintained as undersupply remains a critical factor.

Although there are grounds for cautious economic optimism, rising inflation and interest rates will not only curtail underlying demand for new cars, but also for used models as household budgets are squeezed. However, in addition to ongoing new-car supply challenges, the COVID-19 pandemic significantly derailed the European new-car market from March 2020 onwards. This will reduce the volume of cars de-fleeting after three years.

So, undersupply into the used-car market is expected to persist, which will compensate for diminishing demand. Accordingly, Autovista Group forecasts that the %RV will not decline significantly across European markets in 2023 and 2024.

Double-digit declines

The French used-car market contracted by 13.5% year on year in 2022, with just over 5.2 million transactions, according to AAA Data. This marks a slight improvement on the 13.8% year-on-year decline in the first three quarters but far greater than the 7.8% downturn in the new-car market. There was no improvement in January either, with AAA Data reporting a 6.9% decline in the month.

‘For used vehicles less than five years old (30% of the used-car market), the crisis is becoming acute, with the segment falling by a further 11%. The situation is structural insofar as the lack of availability of recent second-hand vehicles is clearly correlated with shortages in the new-vehicle market. In addition, rising prices are keeping some buyers away, which has been further accentuated by inflation for several months,’ the data provider commented.

Compared to 2021, Germany’s used-car market contracted by 15.8% last year, with 5.64 million transactions. The country’s new-car market fared far better, growing by 1.1%, KBA figures reveal. But the tables turned in January, with used-car transactions up 4% and new-car registrations down 2.6%.

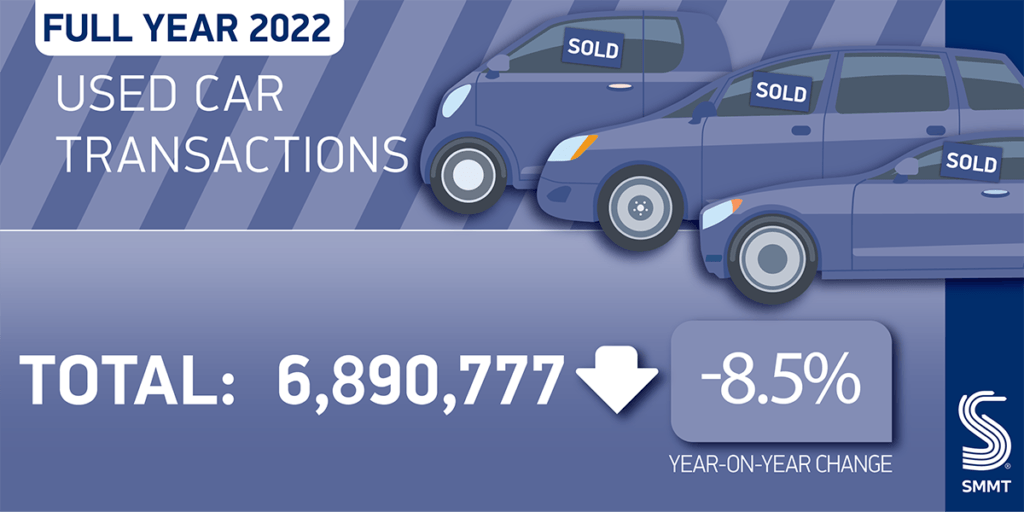

Meanwhile, the UK’s Society of Motor Manufacturers and Traders (SMMT) reports that almost 6.9 million used cars changed hands during 2022, down 8.5% year on year. This marks an ongoing recovery, whereby the volume of transactions was down 9.7% in the first three quarters, having tumbled 18.8% in the quarter.

‘Q4 decline moderates to 4.3%, with 0.8% growth in December, signposting recovery in 2023 as improving new-car market adds stock,’ the association stated. The UK’s new-car market had struggled even more in 2022. However, year-on-year growth since August means there were only 2% fewer registrations than in 2021.

Comparative resilience

In Italy, industry association ANFIA reported that 3.74 million used cars changed ownership in 2022, equating to a year-on-year fall of 6.3%. This improved on the 8.3% contraction in the first three quarters of last year, and used-car transactions gained 13.1% last month.

Meanwhile, new-car registrations in Italy endured the greatest decline among the big five European markets last year. Volumes tumbled 9.7%, although this was markedly better than the 16.3% cumulative decline in the first three quarters of 2022.

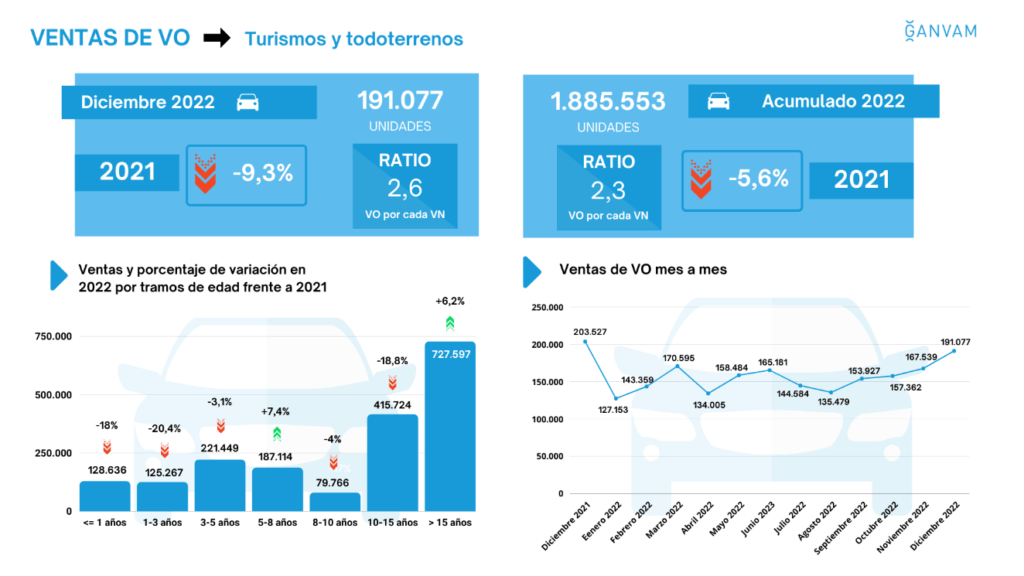

The number of used-car transactions in Spain fell by a comparatively resilient 5.6% last year, to below 1.9 million units according to dealers’ association GANVAM. However, the market weakened compared to the respective declines of 5% in the first three quarters and 4.5% in the first half. Meanwhile, the country’s new-car market slowly improved and suffered slightly less, contracting 5.4%.

The Spanish used-car market started 2023 positively, gaining 1.8% year-on-year in January. However, this pales into insignificance compared to the 51.4% growth of the new-car market and is ‘still 17.1% below pre-pandemic levels’, according to GANVAM.