JHVEPhoto

It is not often I find myself buying US technology stocks, but the collapse in Google’s (NASDAQ:GOOG)(NASDAQ:GOOGL) valuations makes a compelling case for a long position, particularly on a relative basis. After a sharp fall in equity prices and continued share buybacks, the market cap of Google has fallen by 41% from its 2021 peak.

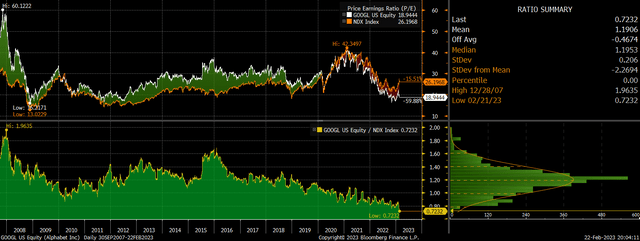

The trailing PE ratio has fallen from a peak of 33x at the peak to just 18.9x, a level that was last seen in 2012. Google now trades at a steep discount to the overall market, particularly on a free cash flow to enterprise value basis, which puts Google’s valuation discount to the Nasdaq 100 at almost 50%. The sheer size of the company means future earnings growth will almost certainly be much lower than they have been in the past, but this size also comes with safety. This, together with the strong net debt position, suggests Google should perhaps be trading at higher valuations relative to the NDX and there is significant scope for relative outperformance over the coming years.

On a trailing PE basis, Google now trades at a 28% discount to the Nasdaq 100, which is the first time in its history that is has been cheaper on this metric.

Google Vs NDX PE Ratio (Bloomberg)

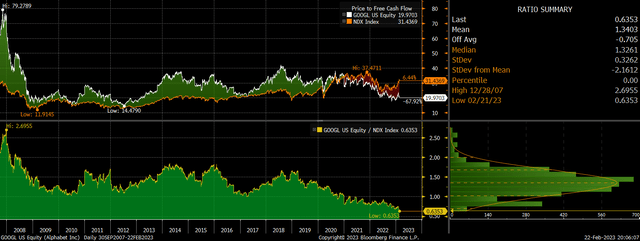

However, the true valuation discount may be even greater than this, as shown by free cash flows. Google’s free cash flows over the past 12 months have been in line with earnings, which is not the case for the NDX, where free cash flows are 17% lower than reported earnings. On a free cash flow basis, therefore, Google’s discount to the NDX rises to 36%.

Google Vs NDX FCF Yield (Bloomberg)

For a company with such a strong track record of free cash flow growth and the leading brand in the global advertising industry to be trading at such an extreme discount, investors must be anticipating a dramatic reversal of fortunes over the coming years. With Google’s earnings now amounting to as much as 12% of total NDX earnings, and earnings making up almost 10%, we should expect a sharp slowdown in growth relative to the overall market. However, a 36% decline in relative earnings, which would be needed to justify the current valuation discount, seems highly unlikely. Such a relative decline would undo all of Google’s relative earnings outperformance going back to 2010.

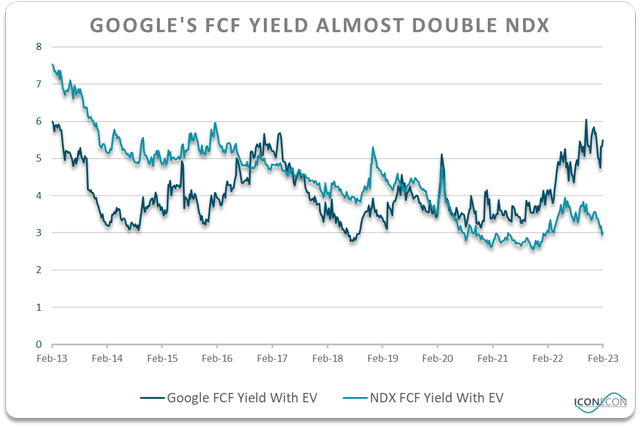

Another positive factor for Google relative to the NDX is the company’s solid net debt position. Unlike the overall tech sector, Google has positive net cash. We can factor this into valuations by looking at the ratio of free cash flow to enterprise value, which includes the market value of debt. On this basis, with a free cash flow yield of 5.5%, Google’s valuation discount rises to almost 50%.

Bloomberg, Author’s calculations

While investors appear to be discounting Google’s stock price based on expectations of weak earnings growth, the company’s size and financial stability suggest a valuation premium may be warranted. Stocks tend to generate strong long-term returns relative to risk-free assets, due in part to their default risk. Investment grade US corporate credit spreads over USTs are currently 123bps according to the Bloomberg index, and the high yield corporate credit spread is 440bps. While I do not know what the average credit risk is for the Nasdaq 100 overall, it is likely closer to the higher figure, as many companies are non-investment grade. In contrast, Google’s credit spread is just 30bps. This suggests that Google’s stock valuation should potentially trade at a premium, all else equal, rather than a discount.