400tmax

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) stock was recently hammered by investors as the arrival of Microsoft’s (MSFT) ChatGPT integration threatens to change the search engine environment. I will discuss my outlook on Google and Alphabet in this article.

Microsoft’s A.I. chatbot sinks Alphabet stock

Alphabet stock has been under serious pressure recently with the arrival of Microsoft’s ChatGPT-powered search engine.

Investors have been worried that Microsoft’s early mover advantage in artificial intelligence-powered search will see them muscle in on Google’s lucrative market for advertising revenues. There was worse in store for Alphabet when it announced the release of a rival chatbot Bard. A Reuters report said that Alphabet’s offering returned inaccurate information and that saw $100 billion in market value wiped from the company’s stock. Alphabet shares are now down 17% from a February 2 close at $188.82.

A.I. search requests cost ten times more than traditional search

The knee jerk reaction to Google’s new Bard offering was likely overdone, as both platforms are still in beta testing that may take years to find a real winner. The company was probably forced into an earlier release than planned due to the hype surrounding ChatGPT.

Google said in a blog introducing Bard:

We’re releasing it initially with our lightweight model version of LaMDA. This much smaller model requires significantly less computing power, enabling us to scale to more users, allowing for more feedback. We’ll combine external feedback with our own internal testing to make sure Bard’s responses meet a high bar for quality, safety, and groundedness in real-world information.

It has not been plain sailing for ChatGPT in recent weeks, and users are becoming frustrated with traffic congestion. That brings serious questions about the ability to scale and there is also the issue of trust as users would be hesitant to break away completely from traditional search habits.

However, the real problem for Google in the battle of the chatbots, is what it does for the company’s bottom line in the near-to-medium term. Google has a huge « moat » in search and is at risk of losing significant market share to Microsoft. Google currently has advertising revenue of $224 billion, compared to Microsoft’s $18 billion, so there is significant potential for the latter to advance.

Google’s revenues have become less reliant on advertising in recent years, with a drop in revenue share from 86.5% in 2017 to 80.2% in 2022. However, that change has been powered by the rise in cloud computing importance, with a revenue share increase from 3.7% to 9.3% over the same period.

The company is now at risk of losing a big chunk of its search traffic to Microsoft, which could see a similar dent in annual revenues, which were reported at $283 billion for 2022.

The outlook for Google’s revenues is a real unknown for investors, and that should be factored into the assessment of whether the current price represents value. The current price/earnings ratio is currently around 20, according to Seeking Alpha data. That is not exactly cheap for a company that is at risk of losing its moat.

The other problem arising from chatbot technologies is that they are more expensive for searches. The CEO of OpenAI, which created ChatGPT, has said the technology has « eye-watering » computational costs. While in a recent interview with Reuters, Alphabet’s Chairman, John Hennessy, said that an AI-powered search will « likely cost 10 times more than a standard keyword search » initially.

This is a bigger problem for Google than it is for Microsoft, which has a more diversified balance sheet. Google may start to lose advertising revenues to Microsoft with ChatGPT and it is too early to determine the longer-term outlook.

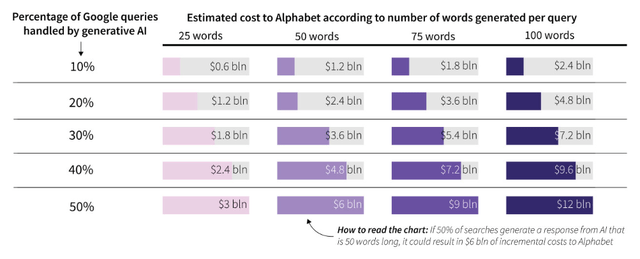

Morgan Stanley analysts laid out the potential increase in costs to Alphabet if AI starts to become the dominant provider of search information.

Alphabet announced a net income for the full year 2022 of around $60 billion. The above costs would eat into that profit, but it would become more of a problem if Google starts suffering on its top line.

Microsoft Making Strides in Search Market

Microsoft had already been making some strides in market share ahead of the release of the ChatGPT integration. The Bing equivalent to Google Ads, Microsoft Advertising, reported in Q4 2022 that the segment’s overall revenue increased by 12% to $51.9 billion.

Google has an 83.84% share of the global search market, although this has dropped from 89.9% in the last three years. During that same period, Bing’s share of the market has risen from 3.9% to 8.8%. The two companies combined currently have almost 93% of the global search engine market share. Yahoo follows with 2.55%, followed by Yandex and Baidu (the two largest search engines in Russia and China respectively).

In a recent podcast with the CEO of Norway’s sovereign wealth fund, Nicolai Tangen, Microsoft founder Bill Gates discussed the outlook for AI in search. Gates told the « In Good Company » podcast:

Google has owned all of the search profits, so the search profits will be down, and their share of it may be down because Microsoft has been able to move fairly fast on that one.

On the outlook for AI, Gates said he was surprised at its development pace and said it will be the « biggest thing in this decade. »

He also suggested that the technology could shake up the current hierarchy of the tech industry.

« A decade from now, we won’t think of those businesses as separate, because the AI will know you so well that when you’re buying gifts or planning trips, it won’t care if Amazon has the best price if someone else has a better price — you won’t even need to think about it, » Gates said.

So it’s a pretty dramatic potential reshuffling of how tech markets look.

Conclusion

Google has been the dominant search engine since its release in 2000 and Microsoft has had to live in the shadows with its Bing offering. The arrival of ChatGPT integration has the potential to level the playing field in search, and investors should be wary of seeing value in the current price of Alphabet. I see the company starting to suffer on its top line as the company’s moat is crossed, and the stock will have lower to go as its dominance wanes.