Guillaume

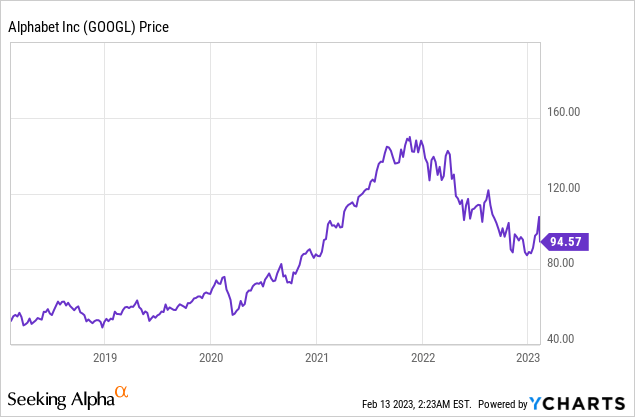

Google (NASDAQ:GOOGL) or Alphabet has recently been in the headlines after the company was left playing catch up after Open AI’s ChatGPT, went viral. Google called a « code red » and hastily showcased its PaLM AI system. This was meant to silence concerns that Google was « left behind ». However, after the model made a mistake in answering a question…the company was left red faced. Its share price plummeted by over 7% in a day or wiping ~$100 billion from its market capitalisation. However, before you go and sell Google stock and join the rest of the herd, let’s get some facts. Firstly, Google has been working on AI for decades and created the « Transformer AI » architecture (which ChatGPT is built on!). Secondly, the « mistake » its PaLM model made was extremely minor and blown out of proportional by the mainstream press. Finally, Google’s PaLM model is ~3 times larger than Open AI’s GPT-3 by parameter number. In this post I’m going to break down the known facts regarding the AI models (from scientific papers), before diving into the intrinsic valuation of Google stock.

ChatGPT Vs Google PaLM

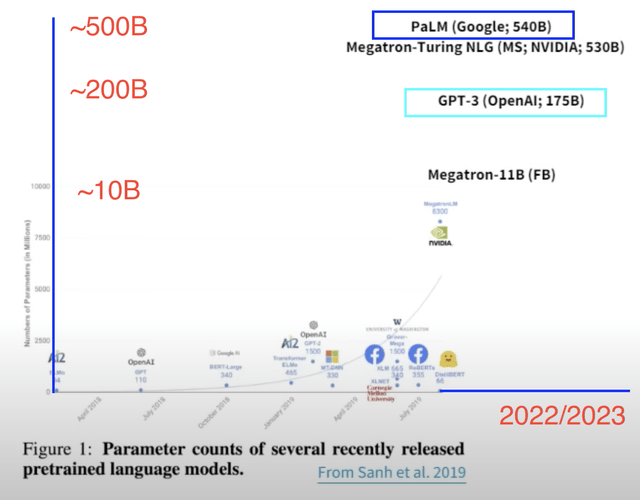

As mentioned in the introduction, ChatGPT or the underlying (GPT-3 model) has received all the « hype », whereas Google’s PaLM model is much larger. According to a graph I have annotated from a Stanford cited scientific paper. Google’s PaLM has a staggering 540 billion parameters versus GPT 3 at « just » 175 billion parameters. Thus Google’s system has close to 3 times (2.97x) more parameters which is huge. In addition, Google pioneered the « Transformer » AI architecture in 2017, which is the fundamental system PaLM and even GPT-3 is built upon. The company does have a habit of releasing its cutting edge research to forward the progress in science. Its brand is respected for this, but moving forward I believe the company should keep its cards close to its chest to avoid opening up to competitors, as in the case of ChatGPT and now Microsoft, which I will discuss more about later.

Large Language Models (Stanford cited research paper)

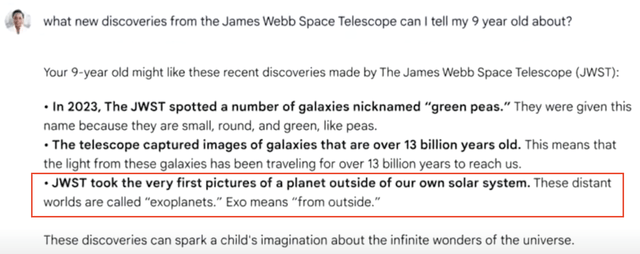

Next you may ask, if Google’s system is much larger, why did it make a mistake? To answer this let’s analyse the « mistake », because mainstream news often doesn’t explain the details. Below you can see a screenshot of the « mistake ». The prompt question asks « What new discoveries from the James Webb Space Telescope can I tell my 9 year old about? ». The third answer (which I’ve highlighted red), says « JWST took the very first pictures of a planet outside of our own solar system ». This is not correct, as the first pictures of these « exoplanets » were taken by the European southern observatory’s telescope in 2004, as confirmed by NASA.

Google PaLM Mistake (Google Presentation author screenshot)

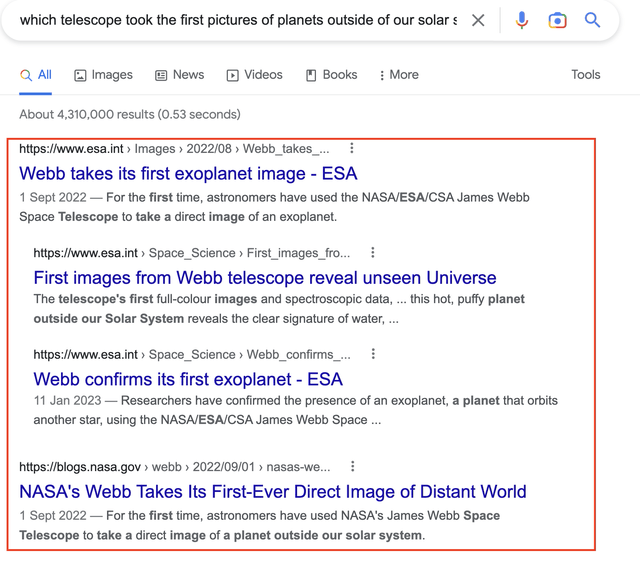

Overall, I don’t deem this « mistake » to be major and was definitely blown out of proportional by the media, thus its stock sell off was likely unjustified. In fact, upon further research I discovered that Google search also makes the same « mistake ». I believe this is because, the James Webb Space Telescope « first took » images of planets outside of our Solar system in 2022, but was not the first to do so. Thus it is simply a word mix up and in fact one could argue that the answer is not actually a mistake. As the prompt asked specifically for « new discoveries », by the JWST which led to the answer.

Google Search James Webb Telescope « mistake » (Author Google Search)

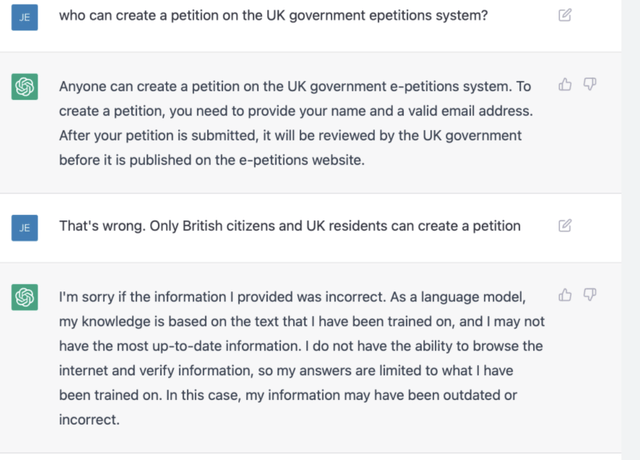

It also makes sense to remember ChatGPT has made many mistakes in the past and these are widely known across the internet. For example the below prompt asks « who can create a petition on the UK government e-petitions system ». ChatGPT answers « anyone », when in reality one must be a British citizen or resident for obvious reasons. In addition, ChatGPT’s training data only goes up to 2021. For example, ChatGPT doesn’t know Argentina won the world cup in 2022. Interestingly, we did not see many of ChatGPT’s mistakes impact Open AI negatively, in fact Microsoft (MSFT) went onto to invest $10 billion into the business.

ChatGPT mistakes (Jerry Fishendens)

I believe the difference in positive/negative media coverage has really been all about expectations. Society has a high expectation of Google and the company has a huge amount of responsibility, when compared with a startup such as Open AI, which effectively had nothing to lose by releasing its system to the public in November 2022.

Google could have released its PaLM model much earlier, as it was announced in April 2022. However, the company has held back for a variety of reasons, from accuracy to safety and bias. Google has a reputation to maintain and thus must ensure its system is immensely accurate before release or its brand would be damaged. In the short term this meant the company has lost out on « hype », but long term it should be better for the platform (as long as they don’t wait too long). In addition, the safety element is important as the language model needs to ensure it doesn’t entice acts of violence, suicide or even help others plot crimes, hack into systems etc.

Bias is also an interestingly area, as often these models may contain lots of stereotypical information regarding religion and races, which could be offensive to others. Then of course we have « explainability », which is the ability of the model to explain how/why it came up with certain answers. Following on from this I noticed a gaping hole in the ChatGPT system. The system doesn’t offer the « source » of any of its information. This means for it to be used as a « search engine » there could be law suits in the pipeline. For example, ChatGPT is « trained » on all the blog posts ever written on the internet, but doesn’t credit the authors. In the traditional search world, when you reference another blog, most people then cite a source (through a backlink). This then gives credit to the original source, while also boosting their website « domain authority » and thus in turn making it more likely to « rank » higher on Google. This system works because the backlinks help generate more website traffic (through rankings), which can then be monetised through adverts and product sales. For example, I have written over 300 blog posts on Seeking Alpha, which has generated millions of views of website traffic and thus a portion of this can be monetised. If a large language model simply scraped this information with no author credit, then there would be no incentive for bloggers to write long term, which would effectively cause the internet’s information to be stunted. Then of course we have plagiarism. I have tested ChatGPT to write mini blog posts on topics and upon running it through a plagiarism checker, copying was detected. Thus this means author credit issues, copyright infringement etc.

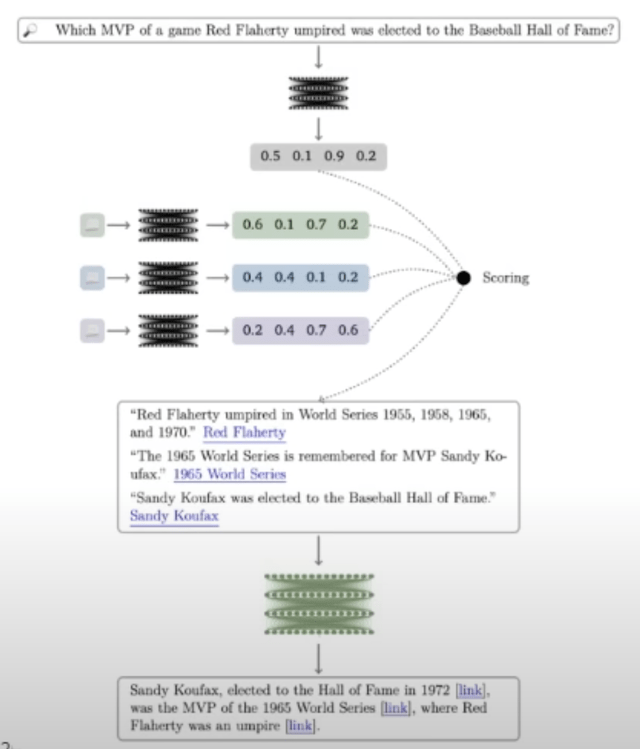

A positive for Google is the company’s core business is internet search, thus the business has a greater chance of introducing sources for data and explainability into its models. In fact this type of technology is called « retrieval based NLP » and is really an extension of traditional search. From the graphic below from a Stanford lecture (sorry about the blur), you can see a question was asked then multiple sources were « scored », before being synthesised into a single answer with links.

Retrieval Based NLP (Stanford lecture author screenshot)

Microsoft « feels » ahead of Google in generative AI after its $10 billion investment into Open AI and its announced plans to integrate into Bing, Microsoft Edge and other Microsoft products. However, upon closer inspection after visiting Bing and downloading the new « AI powered » edge browser I still found this to be in beta mode and I had to join a waitlist.

Bing Generative AI Waitlist (Feb 13th 2023)

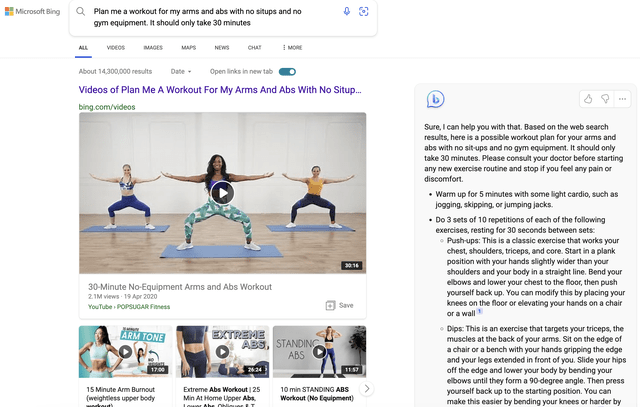

Bing/Microsoft Edge does enable a few stock answers to be given alongside search results, which is pretty messy (in my opinion) and the full functionality is still in the « waitlist » phase. Thus I wouldn’t worry about Bing stealing too much market share from Google anytime soon. In fact, it may actually harm its share as users will likely visit Bing because of the AI hype but then be left disappointed (such as myself). Ironically, in the search term example Bing highlights it ranks a YouTube video at the top (which is owned by Google of course) and is the largest video search engine in the world.

Bing Specific Search Generative AI (Bing)

I also did a review of the Google search website traffic versus Bing. Over the past three months Google has generated a staggering 259.8 billion website visits, which is astonishing. Whereas, Bing has generated « just » 3.464 billion website visits between November 2022 and January 2023. Interestingly enough the estimate shows Bing’s search traffic actually dipped slightly from 1.16 billion visits in December 2022, to 1.148 billion in January 2023. As mentioned above, I am expecting a rise in February but if Bing doesn’t show something unique and special, I doubt it will cause a significant shift in users.

Bing vs Google Search Website traffic (author annotation similarweb data)

Valuation and Forecasts

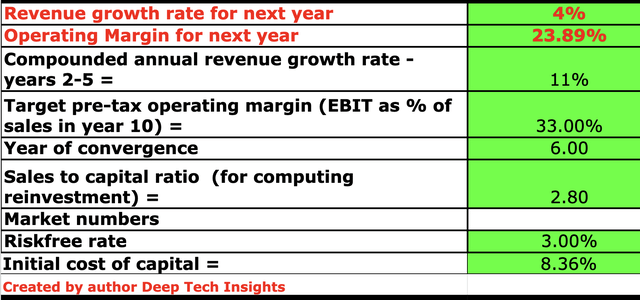

In my previous post on Google I covered its quarterly financials for the fourth quarter of 2022 in detail which you can review. Thus in this post I will just hop straight into the valuation. I have forecast 4% revenue growth for « next year » which in my model refers to the next four quarters. This is conservative but still slightly greater than the 1% year over year growth reported in Q4,22 at $76 billion. However, it should be noted its growth was mostly impacted by an eye watering $3 billion foreign exchange rate headwind. As on a constant currency basis, revenue actually increased by 7% year over year. The U.S dollar has started to correct down relative to the Euro very recently and thus I don’t deem its impact will be as negative in 2023. This is also 1% lower than my previous post as I forecast short term competition headwinds from the new AI developments with Bing.

For years 2 to 5, I have forecast a greater 11% revenue growth per year, this is a 2% increase per year over my prior valuation model estimates. I forecast this to be driven by an improvement in the cyclical advertising market, as well as continued growth in its Cloud business which grew revenue at a solid 32% YoY in Q4,22, generating $7.3 billion. I also expect Google to improve the monetization of its popular YouTube Shorts format (TikTok equivalent), after initial technical challenges.

Google stock valuation 1 (created by author Deep Tech Insights)

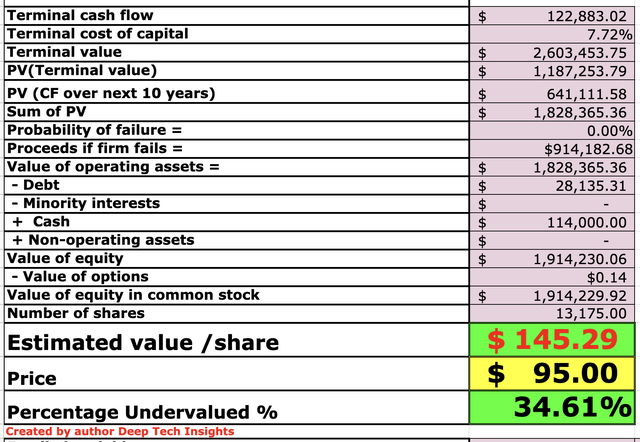

I have capitalized the company’s R&D expenses which has boosted net income. In addition, I have forecast a 33% operating margin over next 6 years, this is 1% higher than the prior forecast given AI tailwinds which I believe will drive extra revenue, once Google formally releases its PaLM AI product to the public. This may seem overly confident but the company has achieved a similar margin before in Q3,21. I forecast this to be driven by the aforementioned factors included Cloud business growth, advertising market rebound and enhanced revenue from subscription services such as YouTube premium.

Google stock valuation 2 (created by author Deep Tech Insights)

Given these forecasts I get a fair value of $145/share, the stock is currently trading at $95/share at the time of writing and thus it is over 34.6% undervalued, according to my forecasts and model.

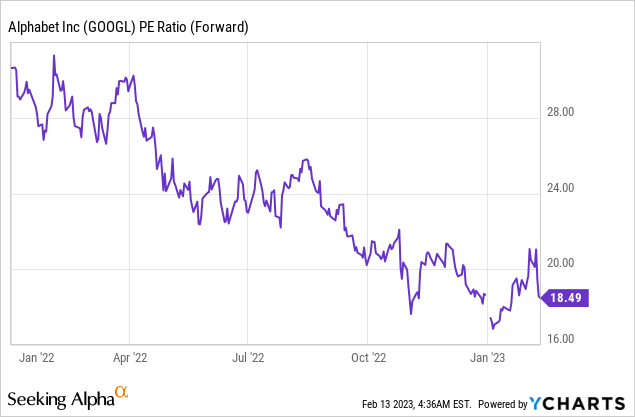

As an extra datapoint, Alphabet trades at a forward P/E ratio equal to 18.42, which is over 31.6% cheaper than its 5 year average.

Risks

Competition/GPT/Microsoft

Google has dominated the search and advertising industry for decades, but now it’s facing competition. As mentioned prior Microsoft’s has invested $10 billion into ChatGPT and CEO Satya Nadella believes the Microsoft Edge browser can now be reborn. On an advertising front Microsoft has partnered with the world’s largest streaming provider Netflix (NFLX), as its official advertising partner, which signals Microsoft’s push into the advertising market.

On a technical front Microsoft (with Nvidia) has created a huge natural language model dubbed the « Megatron-Turning », which has 530 billion parameters. This is 10 billion parameters less than Google’s PaLM, but still pretty close. We do have the upcoming GPT-4, which many believed would be a 10X improvement with over 1 trillion parameters. However, when ChatGPT is asked the figure is closer to 175 billion parameters. Thus there is definitely misinformation going around and Open AI CEO Sam Altman debunked many of these myths. At a StricklyVC event, Altman stated that

“The GPT-4 rumour mill is a ridiculous thing, I don’t know where it all comes from. It has been going for six months at this volume »

He also believed the hype was overblown for ChatGPT and was genuinely surprised by the viral reaction. For extra information, Google search queries are incredibly cheap for the company with the cost estimated to be one fifth of a cent. However, natural language model queries are estimated to cost ~5 times more in infrastructure expenses, according to Morgan Stanley analyst, Nowak. Therefore if half of Google’s (3.3 trillion) queries were converted over to natural language models this could result in an extra $6 billion in costs. A positive for Google is I believe natural language queries will create more unique queries with different use cases in aggregate, thus the net benefit will be positive, as I’ve indicated in my long term model.

Final Thoughts

Google is a tremendous technology company with a strong culture of innovation. I believe ChatGPT is a great « product » and Open AI managed to capture the initial excitement (and training data) of consumers. However, Google has been a pioneer in the AI space for decades and when it comes to search engine integration I believe the company has an edge. The advertising market is going through a cyclical downturn right now and its PaLM model « mistake’ was definitely overblown. Given Google’s stock is undervalued intrinsically (according to my forecasts and model) I believe this is just another greater buying opportunity for long term investors.