Anna Moneymaker/Getty Images News

Investment thesis

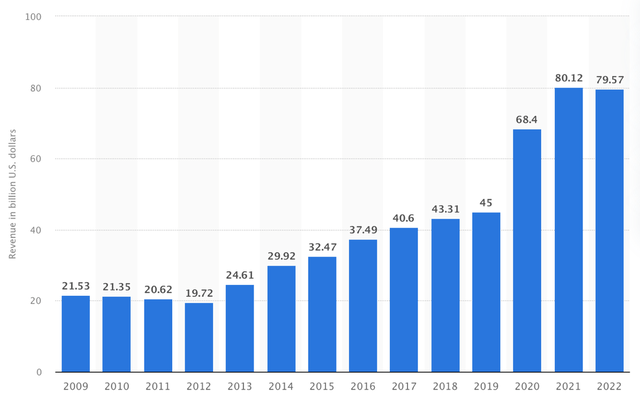

I initiate my coverage of T-Mobile US, Inc. (NASDAQ:TMUS) following my in-depth research of the company, its competitive positioning, and its recent quarterly results. T-Mobile’s superior 5G network, boasting higher speeds and coverage, positions it ahead of its peers, attracting customers. Aggressive pricing strategies and disruptive initiatives have propelled T-Mobile’s subscriber numbers and revenue, growing from $20 billion in 2012 to nearly $80 billion in 2022, with a CAGR of 15%.

The recent Q3 results underline T-Mobile’s industry leadership, reporting best-in-class metrics, impressive net additions, and robust financial performance. The company’s focus on efficiency, synergy realization, and network expansion contributes to strong bottom-line growth and notable free cash flow. Despite cyclical weakness in equipment revenues, T-Mobile’s postpaid service revenues remain robust.

Looking ahead, T-Mobile’s upgraded guidance, strong Q3 performance, and industry-leading growth project a promising future. The company’s financial health, highlighted by a net debt position of $72.8 billion and a shareholder return program, positions it favorably. The introduction of a dividend, though modest, signals future growth potential.

Despite insider selling, T-Mobile’s superior position in the telecom industry justifies a premium valuation. Considering this, its growth prospects, and financial strength, a « Buy » rating is recommended. With a target price of $217, representing potential annual returns of close to 16%, T-Mobile emerges as a compelling choice for investors seeking future leadership in the US telecom market.

The telecom market is more attractive than it seems

The US telecom market is one I find incredibly fascinating. Not for its incredible performance but because the market is hardly comparable to any other. The telecommunications sector is a dynamic cornerstone of the global economy, facilitating connectivity and shaping how individuals, businesses, and societies communicate. As a result, the industry’s global importance is becoming more significant due to technological innovations like smartphones and IoT.

Yet, the sector is not popular among investors (apart from yield-seeking investors) and has not delivered the returns one might have expected one decade ago. For reference, the iShares U.S. Telecommunications ETF has returned a negative 22% over the last ten years, with industry leaders and legacy players AT&T (T) and Verizon (VZ) returning a negative 36% and 22%, respectively, in terms of share price appreciation (not including dividends).

On top of this, the industry requires significant capital investments. Building and maintaining extensive telecommunication networks, including deploying advanced technologies like 5G, requires substantial upfront investments in infrastructure and spectrum licenses. To finance these capital-intensive projects, industry leaders often resort to taking on debt, leveraging their balance sheets to fund strategic initiatives and maintain their market positions in the ever-evolving landscape of telecommunications. Add to this a number of failed acquisitions, and we end up with highly leveraged industry leaders with debt positions of over $100 billion. It’s not necessarily what investors are looking for.

Considering this, the somewhat skeptical view from investors toward the telecommunications sector seems justified. Why invest in this very mature sector in which companies are highly leveraged when we can invest in MedTech, FinTech, the cloud, and AI? Well, for one, the growth outlook for the telecom industry is looking quite strong, with the global industry projected to grow at a CAGR of 6.2% through 2030 and the US telecom market at a CAGR of 6.5%, allowing for quite decent growth for industry leaders. This is driven by the rising spending on the deployment of 5G infrastructures due to the shift in customer inclination toward next-generation technologies, the increasing number of mobile subscribers, and the soaring demand for high-speed data connectivity.

Considering this, the industry clearly presents some potential, to say the least. However, it will be crucial for investors to identify and focus on the better-positioned and innovative newcomers with a better approach and greater financial health. One of the companies best positioned to benefit from this industry growth through its differentiated approach is T-Mobile, which is a relative newcomer, and I am quite bullish on its long-term potential.

T-Mobile blows past competitors on all fronts

T-Mobile US is a prominent wireless telecommunications provider providing wireless voice, messaging, and data services in the United States mainland, including Alaska, Hawaii, Puerto Rico, and the U.S. Virgin Islands under the T-Mobile and Metro by T-Mobile brands. T-Mobile has been formed by a multitude of acquisitions over the last two decades, partially funded by Deutsche Telekom (OTCQX:DTEGY).

The completion of a significant merger with Sprint Corporation in April 2020 marked a pivotal moment in T-Mobile’s history, enhancing its network capabilities and solidifying its position in the industry. The merger with Sprint in 2020 bolstered T-Mobile’s position, combining resources and spectrum assets to create a more formidable competitor. Crucially, it gave T-Mobile an edge in the 5G landscape, owning more 5G radio spectrum than AT&T or Verizon.

As a result, together with AT&T and Verizon, T-Mobile dominates the US telecommunications market, together accounting for 93.8% of all mobile subscriptions, according to The United States Telecom Operators Country Intelligence Report. According to this same report, the total telecom and pay-tv service will only grow marginally through 2027 at a CAGR of 0.7%. However, mobile data service, T-Mobile’s primary product offering, is expected to grow at a more meaningful 5.1% CAGR through 2027, which should result in decent growth for T-Mobile.

Also, over the years, T-Mobile has extended its services beyond mobile into the home internet market with T-Mobile Home Internet. This offering leverages T-Mobile’s 4G and 5G networks to provide high-speed internet access to residential customers. The company distinguishes itself in this market by targeting rural and underserved areas with limited traditional broadband infrastructure. The use of wireless connectivity eliminates the need for cable or fiber-optic infrastructure, making it a flexible solution for deployment and, most likely, the future as wireless technologies rapidly improve.

Across its offering, T-Mobile stands out in the competitive telecommunications landscape, providing extensive cellular network coverage and competing with other major carriers such as AT&T and Verizon. In recent years, T-Mobile has maintained a competitive edge over its peers through a combination of strategic initiatives, allowing it to rapidly gain market share and outgrow peers by reporting significantly more impressive subscriber gains, as I will highlight in the Q3 results.

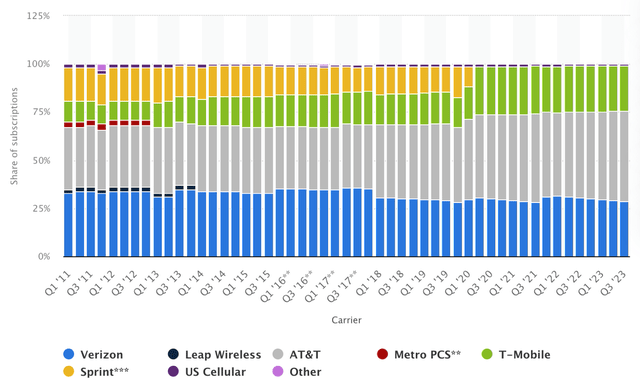

Meanwhile, its differentiated approach has allowed T-Mobile to rapidly gain market share in this highly competitive industry, growing from 11% at the start of 2011 to 16.9% at the start of 2020. While this might seem insignificant, in a highly competitive industry in which it is hard to distinguish yourself, this is impressive. Today, following the Sprint acquisition, T-Mobile controls 23.5% of the US telecom market, measured by wireless subscribers, still trailing AT&T with a 47% market share and Verizon with a 28.6% market share.

US telecom market share by company (Statista)

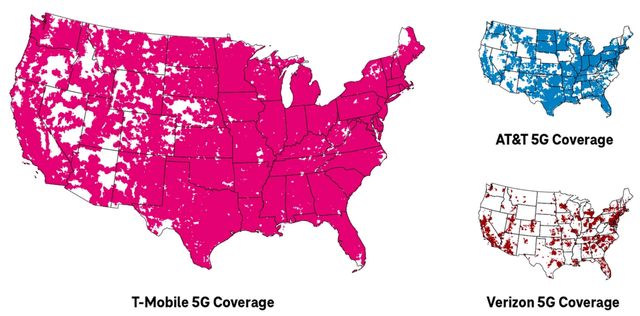

However, T-Mobile remains well-positioned to outgrow its peers and take more market share. How? First and foremost, the company sets itself apart through its superior network. According to the New York Times and several other sources, T-Mobile currently has the best 5G network in the US with the best coverage and network speeds, far ahead of its legacy peers, positioning the company favorably for the future with an edge over the competition.

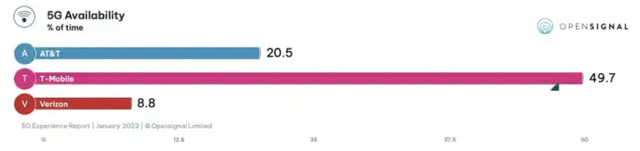

T-Mobile users can expect double Verizon’s and AT&T’s download averages with Ookla’s speed test showing speeds of 163.59 megabits per second on T-Mobile versus 75.68 Mbps on Verizon and 72.64 Mbps on AT&T (5G-only median speeds of 221.57 Mbps, 153.79 Mbps and 101.55 Mbps, respectively). Moreover, T-Mobile’s network is available in over 50% of the tested areas compared to just 20% for AT&T and under 10% for Verizon, pointing out T-Mobile’s superior network coverage. I cannot make it clearer that T-Mobile has a superior network and currently sits quite far ahead of its peers, especially in cutting-edge technologies. It makes me confident that T-Mobile will maintain this edge over the next few years, allowing it to keep attracting customers. As a result, the company will most likely also continue to keep outgrowing peers financially.

5G coverage by provider (T-Mobile US)

This technological edge is a big part of the company’s strong performance in recent years as faster speeds and coverage obviously attract customers. However, the company is also renowned for its aggressive pricing and marketing strategies as it often introduced disruptive pricing plans and promotions to attract customers. The company’s « Un-carrier » initiatives, eliminating contracts and coverage charges, aimed to redefine industry norms.

As a result, while offering a superior, cutting-edge network, T-Mobile also undercuts peers in terms of pricing when looking at the price per MB. Therefore, it is no surprise the company has rapidly grown its subscriber numbers at multiple times the pace of its leading peers. Some might call T-Mobile disruptive, and up to a point, it definitely is.

As a result of this market dominance and, of course, helped by a number of acquisitions, most notably that of Sprint, T-Mobile has grown revenues from just $20 billion in 2012 to close to $80 billion in 2022, representing a CAGR of 15%. Now, of course, without acquisitions, even as T-Mobile rapidly gains market share, the telecommunications industry does not support revenue growth at a double-digit CAGR so it is important that investors do not have the wrong expectations here. As indicated before, low to mid-single-digit revenue growth is a much more realistic scenario, even when including market share gains, as Verizon and AT&T are currently, by analysts, expected to barely grow revenues at all over the next few years.

T-Mobile US revenues (Statista)

All things considered, T-Mobile is a clearly differentiated option within the industry, which should allow it to keep taking market share and win over mobile and Home internet subscribers. As a result, it is safe to assume T-Mobile to outgrow its peers at a long-term low to mid-single-digit CAGR.

The company’s advantage is also clearly visible in its recent quarterly results, which blow its peers out of the water and highlight the company’s superior financial health. Therefore, let’s take a closer look at the most recent Q3 results.

T-Mobile reports industry-leading metrics in Q3

Looking at the Q3 earnings report, the returning sentence throughout the press release is « best in the industry, » as the company continues to report best-in-class financial metrics and growth across the board, which should not come as a surprise considering what I just discussed earlier. T-Mobile is currently beating the competition on every front and in every direction.

Crucially, the company is also ahead of its expansion plans, which allows it to boost growth. The company’s network now has the ability to service 300 million people in terms of coverage, or about 98% of the US population, with its 5G mid-band network a couple of months ahead of target. For reference, as of Q3, AT&T covers only 190 million people with its comparable network.

This opens T-Mobile up to a significant number of prospective customers, who are only just beginning to take notice that T-Mobile is the overall network lever, leaving the company with loads of growth ahead, fueling my bullish stance and the company’s ability to win over customers from leading peers.

In the meantime, the company’s differentiated and durable approach to the industry continues to lead to industry-leading growth across all metrics, most notably leading to faster customer net additions and financial growth. On top of strong growth, churn was also down YoY to just 0.87%, driven by improved customer retention and a differentiated offering. This churn remains below that of its larger peers, with AT&T reporting a churn of 0.95% and Verizon of 0.90%, highlighting once more that TMUS remains best-in-class.

As a result of these factors, the company reported service revenue growth of 4% to $15.9 billion, driven by industry-leading 6% growth in postpaid service revenue as T-Mobile reported strong customer net adds across the board. Postpaid service revenue was $12.29 billion, and growth was 1.6x faster than reported by peers.

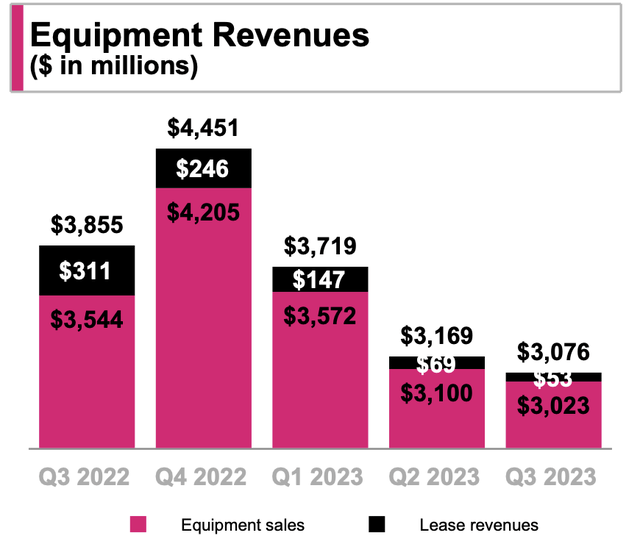

However, while service revenues were strong, overall revenue growth was held back by equipment revenues, which contracted by 20% YoY to $19.25 billion, down 1.2% YoY. This is mainly a result of a lower number of devices and accessories sold due to lower postpaid upgrades and prepaid sales driven by longer device lifecycles. While T-Mobile’s business model is, of course, incredibly resistant to fluctuations in the economic climate, with internet connectivity really being a necessity nowadays, we should not forget that a significant part of revenues is still coming from hardware sales like smartphones. However, as this is a much lower-margin business, barely generating a profit at all but only designed to attract customers, I would not pay too much attention to this cyclical weakness. Instead, the clearest indicator of the company’s long-term success and growth remains its postpaid service revenues, which look as strong as investors could wish.

Q3 financial data (T-Mobile US)

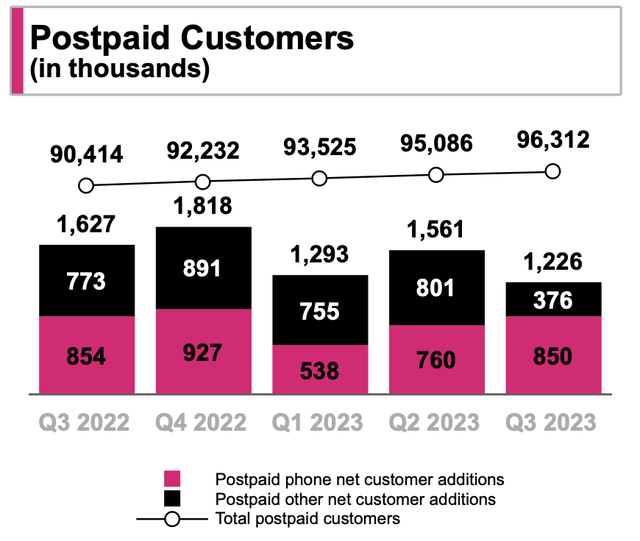

The company reported strong customer net additions in Q3 with total postpaid net additions of 1.2 million, which is miles ahead of what AT&T and Verizon were able to report. This growth was primarily fueled by phone postpaid net additions of 850,000 in Q3, far more than AT&T and Verizon reported together at just 568,000. This clearly shows us that T-Mobile continues to gain significant market share.

In addition to these strong phone net adds, T-Mobile also continues to see great traction in its high-speed internet offering, with net additions of 557,000, bringing the total number of customers to 4.2 million. This was driven by improving demand and was the best growth in terms of customer additions in the industry.

Q3 financial data (T-Mobile US)

As a result of these strong Q3 numbers, T-Mobile upgraded its FY23 outlook and now expects total postpaid customer net additions of 5.7 to 5.9 million, including approximately 3 million phone net additions, which is staggering. T-Mobile continues to fire on all cylinders and gains significant market share. All things considered, I firmly believe T-Mobile will be able to maintain this momentum, leading to a likely industry-leading revenue growth rate at a 3-5% CAGR through at least the end of the decade.

T-Mobile is rapidly improving its profitability

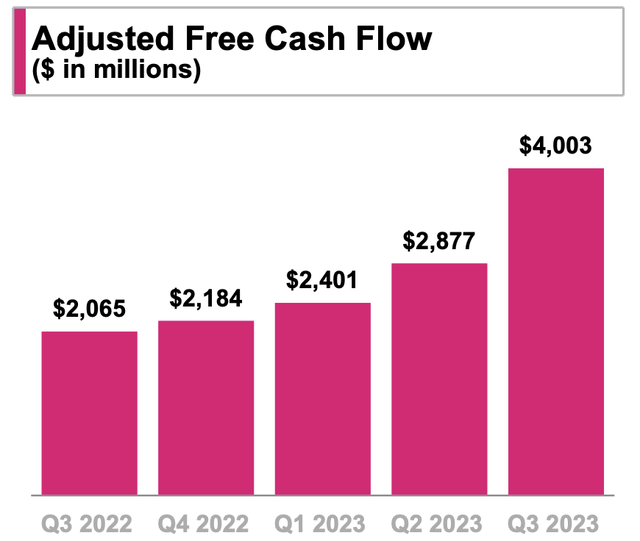

The strong top-line growth reported in Q3, in combination with synergy realization and a focus on efficiency, also drove a strong bottom-line performance with double or even triple-digit growth and the highest FCF conversion in the industry.

Costs fell significantly YoY in Q3, primarily as merger-related costs are easing, allowing the cost of services to decrease by 22% YoY, resulting in these costs now accounting for just 17.4% of service revenues, down from 18.9% one year ago and significantly improving TMUS’ profitability. The company expects to report approximately $7.5 billion in merger synergies in 2023, which will reach $8 billion in 2024. As merger-related costs are expected to keep decreasing in upcoming quarters and years, the company has a significant runway of margin expansion ahead of it.

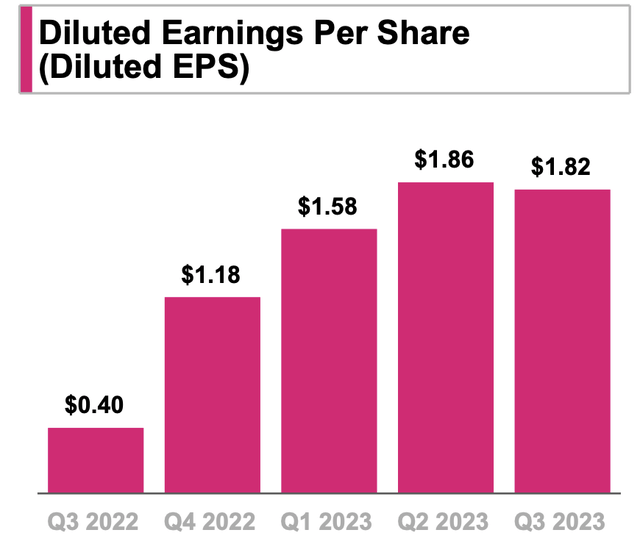

Meanwhile, SG&A also grew steadily at 4% and now accounted for 33.3% of service revenues. As a result of these lower costs, all profitability metrics increased meaningfully YoY. Core adjusted EBITDA was $7.5 billion, up 12% YoY, and net income was $2.14 billion, up from just $0.5 billion one year ago and translating into an EPS of $1.82, incomparable to the $0.40 reported in Q3 of last year.

Q3 financial data (T-Mobile US)

All these significant cost reductions and margin improvements led to an FCF of $4 billion, up 94% YoY and also significantly above previous quarter levels. This represents an FCF margin of 21%, which, despite continued margin headwinds from merger-related costs, is superior to the 17% and 20% reported by AT&T and Verizon, respectively. At the same time, it is safe to say that the company still has a long runway of growth ahead of it in terms of cash flows. As costs are projected to drop going forward while the company continues to deliver industry-leading growth, EPS should easily grow by double digits in the medium to longer term.

Q3 financial data (T-Mobile US)

Following this strong Q3 performance, management has increased its core adjusted EBITDA expectation and now expects FY23 EBITDA to come in between $29 billion and $29.2 billion, up 10% YoY at the midpoint. In addition, management now projects a slightly higher FCF of between $13.4 billion and $13.6 billion, including payments for merger-related costs of just below $2 billion.

These strong and improving cash flows have also strengthened TMUS’ balance sheet. It now has a net debt position of $72.8 billion. While still very significant, the company is in a far better position compared to peers with net debt positions of over $120 billion. Yes, in terms of ratio, TMUS’ net debt/EBITDA of 2.6x is similar to that of Verizon, yet this does not incorporate TMUS’s rapidly improving profitability and EBITDA margins. Therefore, I strongly believe that in terms of financial health, TMUS is looking meaningfully stronger.

Management acknowledges this financial strength as, in September, it introduced a significant shareholder return program of $19 billion through the end of 2024, including $14 billion in share repurchases, of which $11.3 billion is still outstanding, and a dividend of $0.65 per share.

Through the repurchases, T-Mobile will be able to retire another 6.3% of outstanding shares based on its current market cap of $180 billion, which is quite significant. However, it is worth noting that the current share count still sits 36% above the pre-Sprint acquisition level, as T-Mobile issued a significant number of shares to fund the acquisition. Even after these repurchases, the share count remains 27% above the 2019 level. Therefore, these repurchases are primarily a correction of the dilution in recent years. Nevertheless, I am happy with it.

However, I am much more enthusiastic about the company’s recently introduced dividend. As opposed to peers, T-Mobile did not pay a dividend until the recent introduction, which put it on the back of its peers, which pay a very rich dividend of above 7%. T-Mobile’s recently introduced dividend means it now yields 0.4%, which is not quite that meaningful.

However, it is a first step in the right direction, and management plans on significantly growing its dividend in upcoming years. Based on the current dividend, we are looking at a payout ratio of just 9%. Combined with the rapidly improving cash flows, I am quite bullish on TMUS’ dividend growth potential. This is a promising sight for dividend growth investors in particular.

Outlook & Valuation – Is TMUS stock a Buy, Sell, or Hold?

Throughout the article, I have already discussed management’s slightly upgraded guidance, which now points to an EBITDA of $29 billion to $29.2 billion and an FCF of $13.4 billion to $13.6 billion, which most likely points to FY23 revenue of approximately $78 billion. This represents a revenue decline of around 2% YoY, primarily due to the lower hardware sales discussed before.

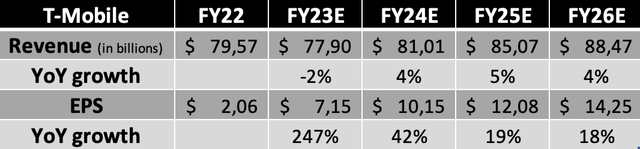

Taking management’s guidance, the strong Q3 results, and my in-depth research into the company fundamentals and its competitive positioning, I now project the following financial results through FY26. This reflects my expectation for industry-leading top-line growth in the low to mid-single digits and rapid EPS growth in the high-double digits due to falling costs and strong top-line growth, driving margin expansion.

Financial projections (Author)

Based on these expectations, shares are now valued at a forward P/E of approximately 22x, which is relatively rich compared to peers with a sector median of just 15x and a peer average of 10x. Yet, this does not consider that peers are expected to barely report revenue and EPS growth in the foreseeable future, while TMUS is growing by incredible double digits. Looking at my FY25 revenue projection, shares trade at a multiple of just 13x compared to a peer average of 8.5, closing the gap quite significantly.

In addition, fundamentally, the situation is very clear, as T-Mobile is the superior pick in the telecom industry, no matter which way you look at it. The company has a superior and differentiated business model with which it rapidly gains market share and is better positioned for the future. In addition, the company is projected to outgrow peers, show significant margin expansion, and is in greater financial health.

What I believe should also be taken into consideration is that Deutsche Telekom owns over 52% of T-Mobile shares and, positively, has no intention of selling as it has been working hard on getting this above the 50% benchmark.

However, on a more negative note, we have seen quite some insider selling in recent months. Over the last four months, there have been six sell transactions amounting to 159,000 shares, with the most recent being a meaningful $14.24 million worth of shares sold by CEO Michael Sievert. Insider selling is rarely a positive indicator, especially when talking about this many transactions. Therefore, I am slightly discounting my fair multiple for now.

All things considered, it is safe to say the company definitely deserves to trade at quite a premium. Therefore, I believe an 18x multiple on its FY25 EPS is warranted here. Based on this belief, I calculate a target price of $217. This means that from a current share price of $156, investors are still poised for market-beating returns of close to 16% annually.

Therefore, I rate shares a « Buy » and recommend investors not to be seduced by the rich dividends offered by T-Mobile peers but to go with the future leader of the US telecom market. The company is exceptionally well positioned, and I firmly believe investors are poised to benefit from significant growth and incredible margin expansion.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

->Google Actualités