Note, this article is taken from a new editorial report from RCR Wireless about ‘private 5G in Industry 4.0 – hype versus reality’. It follows on from an intro section, trailed here previously. The full report extends the discussion further, and is available to download for free here. It draws (and expands) on various interviews and articles over the past couple of months, which are linked in the below text.

A step removed from the equipment makers, and the unique jeopardy that may or may not face (see coverage here and here, and variously), there is another noisy rank of ‘vendors’ interfacing directly with enterprises, composed mostly of system integrators and specialist providers – plus certain progressive operators lately, and a glut of large IT resellers potentially. They represent the default sales channel for private 5G, and proclaim to “understand this technology”, or talk like they do. And if you want the flipside-story about how the hype is real then they will tell it.

NTT DATA, selling enterprise 5G from Celona and Cisco (plus Nokia in more ad-hoc fashion), claims a “$500 million pipeline of opportunities with some of the world’s most disruptive brands”. For reference, it quotes Global Market Insights that the private 5G market will reach $42 billion in global revenue by 2032, up by 40 percent from 2024 and roughly in line with ABI’s top-end forecast (see coverage here). Its own research says 86 percent of firms are “gearing up”. It has a new two-way sales deal with Schneider Electric to bundle private 5G with the French firm’s ‘modular data centre’ (EcoStruxure) product – like a data-centre in a shipping container, with power and climate controls, and so on.

NTT has been installing 5G all across Schneider Electric’s ‘smart factories’ in the US. The two companies have just deployed their joint system at a 30-hectare multi-tenant industrial campus at Marienpark Berlin, in the German capital. NTT reels-off big-ticket Industry 4.0 wins with chemicals companies Albemarle and LyondellBasell in the US, auto-maker BMW in Germany (and maybe in the US, if NTT is involved in BMW’s new 5G plant there), and Cologne and Frankfurt airports in Germany, plus a couple of others for good measure (the City of Las Vegas, the RAI Amsterdam). “We go after large-site / multi-site verticals,” says Parm Sandhu, in charge of enterprise 5G at the firm.

“Anything over 500,000 square feet, $5 billion in turnover, and $50 million in annual IT spend,” he adds. NTT is most interested in, and 5G is most successful in, mega-sized industrial setups, the message goes. Sandhu cites discrete and process manufacturers as key targets, plus “large-scale” logistics in seaports and airports. “That’s the sweet spot,” he says. “That’s where private 5G shines – where it translates into significant ROI savings. Because it provides cost-efficient coverage in complex environments, plus quality-of-service and support for mission-critical applications. We are starting to see double-digit million-dollar deals. They take time and effort, for sure; but they are coming in.”

NTT is not the only one. IBM spinoff Kyndryl has talked in these pages before about scaling 5G to multiple sites at Dow Chemical and Chevron Phillips Chemical (CPChem), among a bunch of unnamed references. US system integrator Future Technologies, a Nokia favourite with a lower profile (but a wide influence, and a hand in the above-mentioned Kyndryl integrations), said in January it had secured “several multi-million dollar” wins among Fortune 100 and 500 industrial firms, and a $150 million pipeline of new sales. At press (April 2024), it issued a note about taking $14 million of orders from the US energy sector in 2023; in conversation, it says it might go vertical-by-vertical through its spiralling 2023 win-totals, as well.

So, is this hype? Or is this real business? Because the boots-on-the-ground in Industry 4.0 are delivering, in notable volume. Peter Cappiello, chief executive at Future Technologies, reflects: “It’s so frustrating to see these companies put out statements about pilots they’re selling. I mean, we’re getting paid to do these; they are real networks. We’re private; we have no debt. Lots of other companies [which talk about enterprise deployments] have raised capital, and don’t even have enterprise customers. We’re doing network transformation with customers we’ve worked with for years. We’ve been doing private cellular for 14 years – so we’re way more mature than most others.”

He lists a bunch of customer references (which must remain private, he says) and it reads-back like a who’s-who of stateside early-adopter industrialists in the private LTE/5G sector – to the point, almost, that its fingerprints appear like they are across most serious private networks in the US. It includes factories, refineries, mines, ports, army bases, plus a bunch of others. He says: “We have gone from a regular $30-$40 million pipeline, to burst it over the $150 million mark. And you know, we’ve been around for 25 years; some of these others talk about their pipelines, and it’s nonsense. But we are adding seven figures to it every week – because we have this proven methodology.”

What methodology? It is worth hearing him out just because the implication is that, away from the hype and bluster, parts of the private 5G market have settled on a deliberate process to scope the problem, articulate the value, and deploy the solution. Cappiello explains: “We get introduced, we get the idea, we retrieve the blueprint: vendor X for the radio, vendor Y for the core; or maybe X for both. We look at the use cases, we look at the devices; and then we set up a 30-minute call where I present a couple slides about the company, and then handover to the former CTO of Georgia-Pacific to walk through a series of live use cases and applications in our own living lab.”

Some context, here: Cappiello recruited Gary Hill from US pulp-and-paper manufacturer Georgia-Pacific four years ago as chief operating / innovation officer with a brief to “build a living lab”. Future Technologies has invested about $2 million in the site, says Cappiello. “Because use-cases are what drives this,” he explains. Hill has the right profile, he says; at Georgia-Pacific, Hill effectively ranked among the top manufacturing customers for Intel, Verizon, AWS. “This stuff matters to customers – that someone on our side has worked on their side.” He goes on: “So we say, ‘Right, we are going to show you what we do’. And we show them a 5G core network, and they see it and they get it.”

He replays the conversation: “‘Oh, it’s a server,’ they say. ‘Yep, and the core is a telco workload’. ‘Okay. I got it.’ Okay, so good; and then we show simple carpeted use cases, like some Zebra tablets and scanners. They’re like, ‘Right, yeah; we have them, too’. Okay; yeah; we’re tracking. And so we show them the training space, three 25-person classrooms; we show them the training towers. We explain that our goal is to train them, and enable them. And then we show them all these high-runner use cases – connected worker, remote worker, with every device you can imagine; a HoloLens running Tactile, RealWear running Librestream. They’re like, ‘Okay. We like that.’

“And then, we have an IoT health sensor running AI/ML, and a 5G AMR running around in the background. But we also have a conveyor belt with a Cognex camera connected on fibre. ‘But I thought you’re selling us 5G?’ And we say: ‘No; in this environment, we have everything. Because you have everything. We have wired, because you have wired. We have Wi-Fi, because you have Wi-Fi. We have fixed-wireless broadband and public cellular.’ Because this is like a blue-collar lab. There are no white lab coats. We’re not trying to show what’s possible in 2030. ‘You’re a real business,’ we say, ‘with real operations’. We will show everything the customer might deploy – today, in 30 minutes.”

All of which says that, even with just 0.0003 percent of the addressable market covered, private LTE/5G is finding its mark with certain enterprises; it says that resellers like Future Technologies, plus NTT and others – plus equipment vendors like Nokia and Celona, and others – can explain its value to enterprises in language they understand, and make its value stick. It is not hype, then, that cellular has a job to do in large enterprise venues; the question is just how much of a job it has, in how much of the market. And if you want a glimpse of the future, of how 5G finds its groove beyond the Industry 4.0 vanguard, then you could do worse than ask a test company. Which is what we did.

MIDDLE MARKET

Across the workbenches at UK-based Spirent, the clearest trend is for smaller and simpler systems, says Stephen Douglas, the firm’s head of strategy. “We’re seeing lower-cost, smaller-footprint private networks-in-a-box, particularly in North America; and development of capabilities so they can be deployed in an automated fashion.” The point is to jettison functions, reduce costs, and automate complexity – and thereby to open new markets. The ambition is to make private 5G accessible to more than just big firms with deep pockets, with which it has tended to find a natural home until this point. “The supply industry wants to sell to smaller businesses,” he says.

Smaller businesses – as in the mass-market? Douglas qualifies his previous statement. “Well, probably less-small sized and more medium-sized, at this point,” he says. “[But] there has been a whole change in mindset – from slow and complex 5G installations to lighter-touch 5G offerings, comprising just a few radio cells and a stripped-back core network, with only the network functions that you actually need, rather than all the stuff that goes into a public network.” This is the line from Verizon Business, also, which has refocused and retooled its global sales operation (‘5G acceleration’ team) over the last 18 months, and is suddenly hoovering up ‘mid-market’ sales in the US.

Jennifer Artrley, in charge of the edge-5G enterprise team at the US operator, comments: “We have closed as many private network instances in the US mid-market to date in 2024 as we did all of last year. The funnel has more than doubled; the late stage opportunities in the funnel have more than tripled. We are out there, and I am adding salespeople to the team.” Of course, that sum – as many sales in a quarter of 2024 as in four quarters of 2023 – might just be four-times not-very-much. But the headcount in Artley’s unit stands at 250-odd, up from about 150 in early 2023, and Verizon Business is in the game – mostly, perhaps surprisingly – via the US “middle-market”.

In other words, even as deep-pocketed global enterprises ($5 billion firms with $50 million budgets, say) kick the tyres on complex Industry 4.0 integrations, as a precursor to mass-market adoption, Verizon Business is switching on light-touch LTE/5G in small- and mid-sized firms (SMEs), in shared-access CBRS airwaves and localised tranches of its own spectrum. It is not supposed to go like this, of course; the mass market is supposed to follow the early market, and the early private-5G market was supposed to be about production-line pyrotechnics in Industry 4.0. “Honestly, we’d written-off that part of the market. We just didn’t think the SME sector was the right target for private networks.”

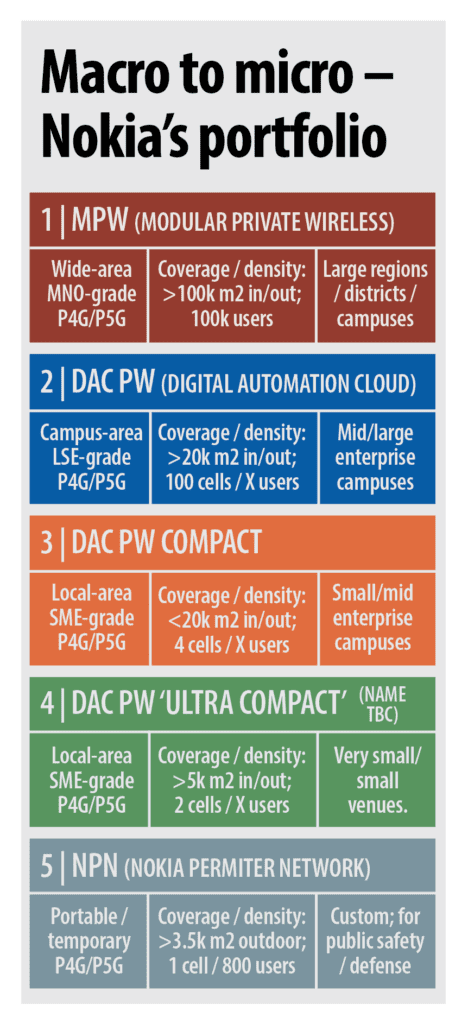

The fact the SME market is the right target, already – in sales, latterly, and in test, presciently – suggests the hype has substance. Back to Douglas, who says the test products in the Spirent labs do more than just strip-back technology and abstract complexity into automation software; vendors are bundling-in edge compute hardware and application software, as well, he says. This is Nokia’s strategy with its MXIE system, built to run Industry 4.0 apps next to the core network, as well as with its multi-layered private 5G connectivity portfolio, set to be bolstered (post-summer) by a new ‘ultra-compact’ version of its Digital Automation Cloud (DAC) product.

The Finnish vendor wants an early shot at the mass market, composed mainly of SMEs, forming the engine room of the global economy. The statistics are hard to judge, but the Small Business Administration (SBA) says SMEs make up 99 percent of all private businesses and 47 percent of the private workforce in the US; the numbers tell the same story in most ‘industrial’ nations. “We said 14 million [industrial] sites – which is one million large sites, two or three million mid-sized ones, and everything else is small or very small,” explains Stephane Daeuble, responsible for enterprise solutions marketing in Nokia’s enterprise division. “So we need to tap into those markets.”

The ‘ultra-compact’ DAC product, as yet unnamed, will support a couple of radios, and compete with Wi-Fi in small venues. Its DAC Compact version, launched last year, supports up to four radios in small-to-mid sized indoor venues (up to 20,000 square metres). The original DAC solution, which has fuelled most of Nokia’s sales, supports up to 100 cells in campus setups (over 20,000 square metres). The DAC portfolio is complemented by its macro-sized Modular Private Wireless (MPW) product for wide-area projects, and micro-sized Perimeter Network (NPN) product, which fits in a bag (like Spirent’s test cases) and is customised and resold by specialist partners.

In reality, Nokia’s sales lens is still trained on bigger enterprises; it is just that these firms want a lighter-touch solution to flow-into their smaller sites. But logic says the mass SME market will follow in Nokia’s Industry 4.0 offensive, as it will for its rivals, and the hype will gain credence again. Daeuble says: “More and more large companies ask us for smaller sites. We’ve done their large sites and we’ve done their medium sites, and they’re now asking us to cover 2,000 small distribution centres with the same solution… Or they say, ‘Okay, we’ve done the 40 big ports; I want to do the next 60 medium-sized ports, and then the next 200 small-sized ports’. But they want something cheaper.”

He adds: “Those markets were not very aware of private wireless before, or willing to do much with it. But now we can present them with a single radio and a single blade, and cover the entire [small-sized] port.” The sense is Nokia is out on its own; but the word from the test labs is that rivals are readying similar options. “Certainly this trend for bundling is coming into the test arena,” says Douglas. In ways, the bent for simplification is a direct response almost to the stop-start progress in the manufacturing sector, the original Industry 4.0 poster child for private 5G. It is not quite; it is a natural evolution and logical response to scale the technology in the mass market.

But manufacturing is hard, notes Douglas, and private 5G remains a developing technology, which, as yet, does not quite deliver sufficient features or confidence for manufacturing companies to fully get behind. That will happen, but it will take time, the message goes. “It is a more complex environment; the use cases are more challenging. A lot are dependent on Release 16 and 17 feature sets; and Release 16 features only started to come available to equipment makers last year; 17 will come this year. So there is a time lag in manufacturing; and an issue, as well, because of the focus on smartphones and [then on] CPE units… We are only now starting to see proper focus on industrial devices.”

There is a rush of interest in RedCap for industrial IoT, he notes; but again, it is a future technology, which does not hold enough immediate value for manufacturing companies, generally, to scale their private 5G experiments into loaded multi-site systems. “RedCap is not really going to be available in the market for another year, at best. So manufacturing is stuck in trial-mode, to a greater extent – just because of the availability of technology,” he says. And because of the difficult terrain in manufacturing, also; all good for test companies, it would appear. But Verizon Business, as part of its own strategy-shift, has recategorised manufacturing as a “horizon-two/three opportunity”.

Arvin Singh, recruited as global head of 5G solutions and innovation in late 2022 as Artley’s private 5G unit paused to take stock, reflects: “The team had been looking at all these complex areas – all this manufacturing with robotics, and so on. Which is exciting. But there is a roadmap and a sales cycle, and a whole ecosystem that goes with it. So frankly, Industry 4.0 has lagged two-to-three years behind the hype on private networks. And the mission Jen (Artley) tasked us all with 18 months ago was to land-and-expand – without losing sight of those horizon-two/three possibilities. The question was: what can we do now to get in the game?”

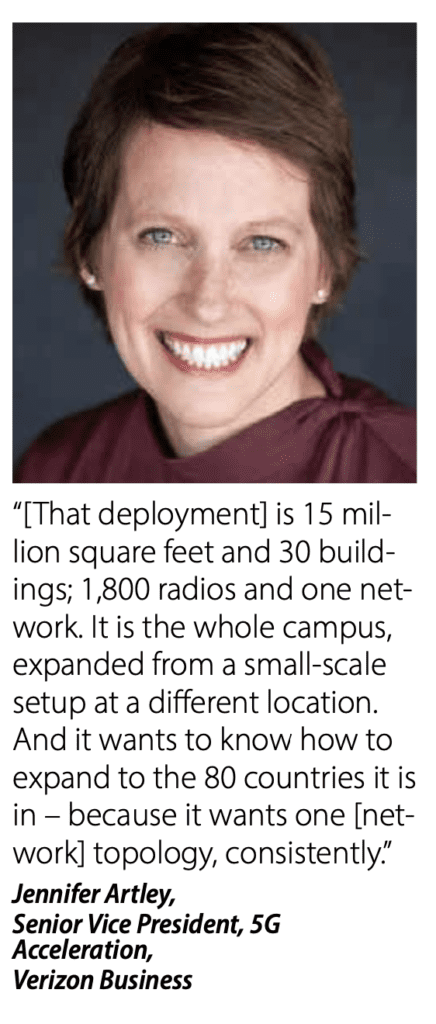

As discussed, its way into the game, three years after it first planted its flag in foreign soil with Associated British Ports, and 18 months after it took its own organisational structure in hand, has been via the US ‘mid-market’. Which is not to say Verizon Business has eschewed big-ticket Industry 4.0 affairs for “mom-and-pop” deals in CBRS spectrum. I mean, that can’t be right, surely – when there is a chance, suddenly, to set up as a 5G provider to businesses in any market (spectrum permitting) in the world? “Not at all,” responds Artley. “We run the whole gamut. We’re finding applications for more basic CBRS deployments, but the most exciting opportunities are in global enterprise.”

She offers up its multi-core installation at an Audi test track in Germany, to duplicate global network conditions at a single site, as an example. “That was a long development cycle because we were working to see what was possible. And what’s possible is pretty phenomenal.” Coverage of the Audi setup can be found on the RCR Wireless website; the conversation skips to other (uncited) deals, and to how the company’s “land-and-expand” motto translates to large enterprises. “In the mid-market, it means volume – getting lots of wins on the board. In global enterprise, it is about selling the first location, and then expanding the use cases on top, or else expanding to more locations.”

Verizon Business sold its first private LTE/5G (probably LTE?) network to an oil and gas refinery in August, she says; it sold five more to the same customer in October, and seven more in December. “They see the benefit, and want more of it – and so it scales geographically. Similarly, she tells how a pharmaceutical company, another industrial ‘first’ for the team, has taken a private LTE/5G network from Verizon Business in the last few months, and returned “two months later” with a much more complex brief. “It is a more complex network, and a more complex solution,” she says. “And more complex than the oil and gas example.”

She adds some colour. “It is 15 million square feet and 30 buildings; 1,800 radios and one network. It is the whole campus, expanded from a small-scale setup at a different location.” In a market that has found upwards- and outwards-scalability (applications and premises) difficult over several years, these deployments represent real two-way ‘expansion’ – and tell of a licensed operator embracing unlicensed spectrum in global markets. But while they are prime examples of private LTE/5G at-scale, they are not what you might call conventional manufacturing – as in the kind of discrete assembly-line discipline that gets conflated with Industry 4.0 in popular legend.

Indeed, the conclusion from this anecdotal, mostly uncited, rush of sales is that (discrete) manufacturing is a hard-sell for private 5G, and that any disillusionment in the wider market is probably because of this; plus that the impossible task to make an undercooked version of industrial 5G relevant to manufacturers has forced the vendor market to look elsewhere. Which is what has happened. Precipitated by the anti-complexity trend, 5G has landed in other climes. “Most growth over the last 12 months has not been in manufacturing, but in seaports, public venues, and the government and defence sector,” says Douglas. “And it has mostly been to provide coverage to large campus areas.”

This is echoed by everyone. For perspective: Nokia, which claims an almost-50 percent (GSA) share of the private LTE/5G market, has 710 customers (at March 2024); half (49 percent) are mostly for legacy wide-area MPW networks, which pre-date its DAC assault on liberalised ‘vertical’ bands. They are, to a greater extent, in the government and utilities sectors, where macro LTE/5G is still required. About a quarter (23 percent) are in manufacturing and a fifth (20 percent) are in transport/logistics; both markets have grown from nothing four years ago, when the DAC system was introduced. But the fastest growth, says Nokia, is not in discrete (parts and assembly) manufacturing – where the hype has focused – but in process (ingredients and recipes) manufacturing.

In other words, it is in the making of beverages, petrochemicals, pharmaceuticals, and so on, plus in seaports and airports (logistics) – rather than in the more iconic production of vehicles and machinery. Daeuble says: “We ignored some markets – like process manufacturing, which splits into a dozen segments – where our stuff makes lots of sense, and brings lots of value. Because they’re less advanced in terms of automation, say. So we’ve put a lot of focus on that and we are getting a lot of big deals.” High-profile clients like BASF, Chevron Phillips, and Dow fall into this basket. “But we have 10 new markets this year as well,” he adds. “Which shows we are covering new ground.”

This article is taken from a new editorial report from RCR Wireless about ‘private 5G in Industry 4.0 – hype versus reality’. The full report extends the discussion further, and is available to download for free here.

->Google Actualités