Jian Fan/iStock via Getty Images

A little over a year ago, I analyzed QUALCOMM’s (QCOM) reign as the 5G modem king would continue thanks to Apple’s inability to produce a modem of its own. This proclamation wasn’t due to my biased opinion of either company but rather Apple’s (NASDAQ:AAPL) failure to produce a modem and the lack of registered device testing showing it’s nearing the final stretch. And now, with a new supply agreement signed, the debate can be put to rest for the next three years: Qualcomm is the 5G modem king, and Apple has nothing close to ready for prime time in the modem space. The question is, will Apple continue to sink money into this endeavor, and will it pay off? Meanwhile, Qualcomm’s benefits are obvious: no loss of earnings in its handset division due to defecting customers.

Naturally, you may be asking what a 5G modem has to do with the need for a CEO change. It may seem like a large logical jump within the investment case, but the implications of spending billions without, first, a return on it for what’s now going to be at minimum seven years, and second, the reward of the investment providing no revenue growth plan or innovative path means there’s no vision or capital allocation wisdom from management.

The History

After buying Intel’s (INTC) modem division in 2019, Apple sought to develop a 5G modem (and, as likely, an RF (front-end)) chip so it could replace Qualcomm’s chips with its own. The idea was to rid itself of the dependency on another company calling the cost shots and have design flexibility. It sounds good in theory, but as I argued in my 2022 article, Apple was starting on the wrong foot with a failed and abandoned modem team. Intel admitted defeat because Qualcomm’s IP was too strong to compete with and sold the division at a meaningful loss.

To make matters worse, Apple set out to replace the best 5G modem on the market. This meant creating the industry’s best modem to maintain its product quality. It’s just one component but a significant one to replace in-house, and I put it this way:

Apple’s misstep was trying to replace the number one 5G modem system. Please don’t misunderstand me here: anyone can unseat the incumbent. But this creates a requirement to go from the best connectivity component in your prized product to your own while maintaining the quality your customers have come to know. The new modem must work as well or better than the one Apple is replacing – as many or fewer dropped calls; as fast or faster download and upload speeds. And because of Qualcomm’s market-leading products, it means creating a market-leading product.

And because the modem doesn’t work in isolation, it requires deep integration with the RF side of the connectivity system, requiring even further R&D on Apple’s part to create a complete solution.

None of this is easy. I’ve said this time and time again – this is not like designing silicon for a processor; the RF space is far more complex and requires far more science and physics to arrive at a working product. Above all, it requires not stepping on Qualcomm’s (and others’) IP in the process, lest you find yourself in an easily lost lawsuit. And since Qualcomm invented many cellular communication methods for 4G and 5G, it has the know-how and the patents.

This isn’t to say Apple couldn’t invent something new and provide a different path in RF communication, but it has taken Qualcomm many, many years to do so. Not to mention, Apple has no background in wireless technology. It’s a consumer product designer who has strayed into CPU silicon, and even with Intel’s former modem team, managing a wireless endeavor properly is an entirely different story.

Apple’s 5G Struggles Have Been Predictable

This brings us to present-day struggles and results.

On Thursday, a report about Apple’s modem efforts hit the internet. What it reported was stunning (but not surprising), to say the least. After billions of dollars and four years of active work, Apple’s modem is supposedly three years behind Qualcomm’s. Based on the commentary, however, I put its progress at the same level as the beginning of the industry’s foray into 5G, or further behind than just three years’ worth of difference. It would mean Apple took four years to gain one year of progress.

Other Apple executives lacked experience with wireless, said former project engineers. Consequently they were setting tight and unrealistic deadlines.

Or they did until late 2022 when Apple began testing prototypes. Reportedly, Apple’s 5G modem chips were poor enough that they would have made the iPhone’s wireless speeds slower than Android.

People said to be familiar with the tests are said to have estimated that Apple is three years behind Qualcomm.

Slower than Android speeds would bring pause to anyone at Apple working on its modem. Remember what I said in 2022 and repeated at the beginning of this article: Apple must maintain the same quality and functionality as Qualcomm’s chip to deliver the top-quality products it’s known for. Anything short of that would be considered a project failure, tossing away its customers’ goodwill with a subpar product.

But the problem is Apple isn’t chasing down a static target. As modem technology improves, companies like Qualcomm enhance their technology and IP each year, which means Apple must always be working toward something moving away from it even if it objectively moves forward from where it was. Its displacement might be positive, but its relative position is the same. Therefore, it must work faster and better than Qualcomm has over the last five years.

Thus far, it’s not the case, and why I pointed out the one-in-four-year progress.

Three years in the modem world might as well be the 8th grade to a 201 college class – you don’t even know what you don’t know.

And the « three years » piece is relative to what the industry had three years ago. Apple doesn’t even have a prototype worth putting in the next phase, where it tests speeds in the real world. Lab tests will always look better than real-world experience, and if the slower-than-Android-speeds are in the lab, then the real-world implication is the company won’t have competitive speeds three years from now either.

We now know the struggle to overcome Qualcomm will continue for another three years, as Qualcomm announced it signed an agreement with Apple for modems through 2026 – the next three iPhone model launches.

The Implications For The Next Three Years

This supply renewal means another three years of Apple banging its proverbial head on the workbench. If its progress over these last three years has amounted to a modem unable to have lab tests faster than a low-level Android phone, it means Apple hasn’t cracked the code. And even if it succeeds in these next three years (which I’m doubting), it’s stuck with Qualcomm regardless.

Some might be quick to say, « That’s more than you could do! » or « It takes just a little bit of progress to get to the goal. » The problem is the goalpost is never static. Apple is running a 10K after starting a lap down and is running a minute slower mile pace than Qualcomm. The interval continually gets wider. Not to mention, merely solving a 5G problem sets it up to be behind the same or more on the subsequent technology (5.5G, 6G, etc.). By 2026, 5.5G will be in the mid-stages of en masse deployment. It might claim success on a 5G chip by then, but it won’t be the chip the next-gen iPhone needs to compete on a global scale.

Apple is pouring billions of dollars into a complex chip on its flagship product, which carries the entire company. And the implication is important: Apple has no better place to invest in innovation.

Yes, before you get out of your chair, Apple can invest in multiple places at the same time – it’s not the only investment it’s making in its quest for growth. But spending many billions of dollars and many years on arguably the most complex chip and system in the world with the least chance of success doesn’t make sense. And it’s being proven with each supply contract it has to sign. It only makes sense if the company has reached the end of the innovation road and has no modern « iPhone moments » coming down the pipe.

And this would be quite the confession and should not be Apple’s drive if it wants to return to meaningful growth.

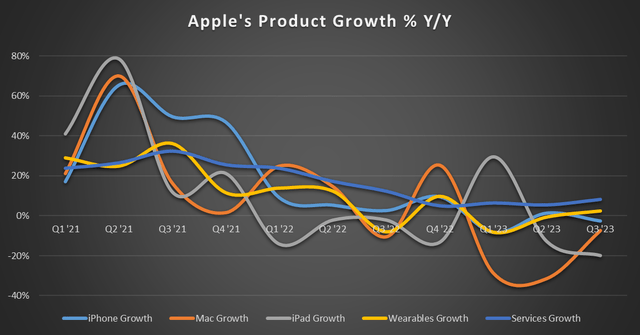

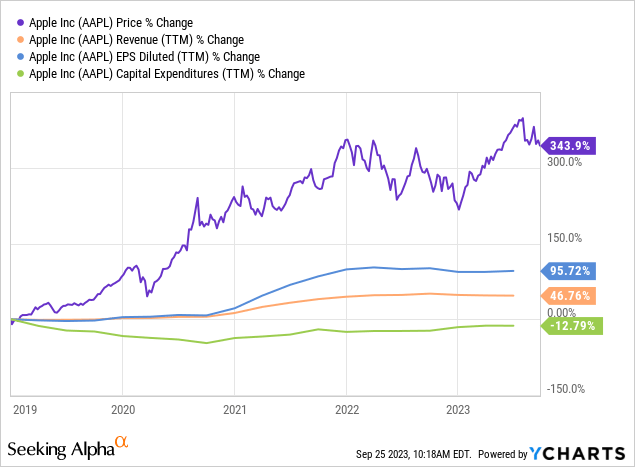

This need to innovate comes at a time when growth is stagnating for all of its product lines. After passing the pandemic’s easy comps in 2021, growth has flatlined, most notably for the iPhone.

Apple’s Quarterly Earnings Filings, chart mine

Apple’s former glory was inventing new consumer electronic devices: iPod, iPhone, iPad, etc. These set the standard for product lines everyone else copied, yet Apple still came out on top in market share.

But then it fell behind.

Samsung produced the first mainstream smartwatch in 2013. Apple was the « copier, » in this case, as the first Apple Watch released in 2015. Ten years ago showed a worrying start to a lack of innovation.

Moving into designing the non-CPU components of its product doesn’t lend itself to innovation, not with the most complex system on any of its products. It can’t even get on par, let alone innovate a 5G modem and RFFE, so there’s no innovative path in this direction. Even if it were successful in its 5G modem investments, another company would have to manufacture the chips and components.

Apple needs to work on the next « thing, » the next hot consumer product – one it pioneers – and create another line of revenue.

These Investments Are A Sign Of Apple’s Poor Leadership

So, what does an investor need to look for?

First and foremost, better allocation of CapEx toward growth-driven initiatives. At best, an in-house modem doesn’t create a new product line; it merely shifts costs from external to in-house in a stagnating line of products. The reward for this investment doesn’t change its revenue trajectory. It might squeeze a few pennies out of EPS, but what good is that if the top line continues to struggle?

But it’s not just a benign investment where it’s just some money burned.

This latest supply agreement allows Qualcomm to easily fund its R&D as the $2-$3 in net income translates to roughly $2.81B at the midpoint, which is 31% of its expected R&D expense for FY23. If Apple were to leave it as a customer, Qualcomm would still need to provide the same 5G modems and systems to other customers, so it would still require R&D for the same product. Therefore, this ultimately means Apple continues to fund its would-be competitor’s advancements in the very chipset it’s trying to design.

Not a very savvy business path for Apple when you look at it that way.

All of this reflects the poor leadership Apple’s board has come to be satisfied with. Therefore, Apple needs a CEO change, akin to Microsoft’s (MSFT) shift from Steve Ballmer to Satya Nadella.

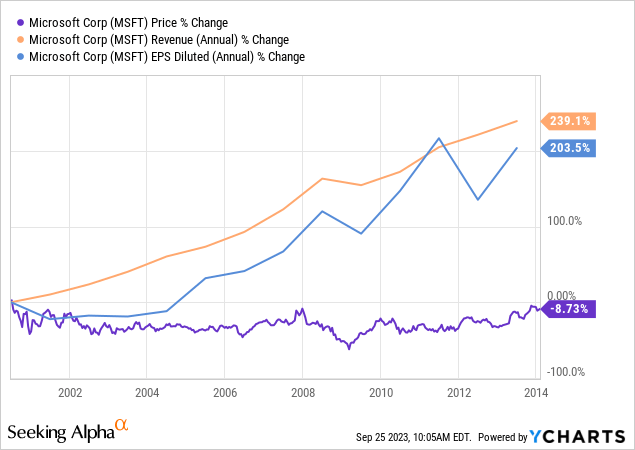

Under Ballmer, Microsoft’s stock stagnated, and revenue and EPS « only » tripled in those 14 years.

(Steve Ballmer’s tenure over 14 years)

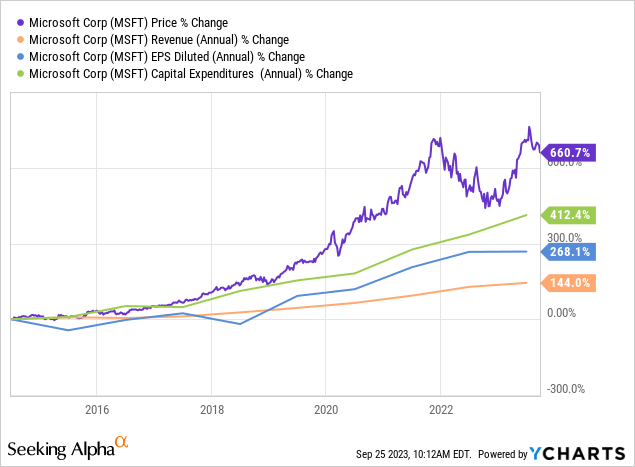

Nadella, in less than nine years, exceeded Ballmer’s EPS growth and is on track to exceed revenue growth well ahead of the 14-year mark. Meanwhile, the company’s stock price is in two different universes, even with arguably comparable financial performances. The vision of innovation and being a leader in new spaces can drive share price sentiment far beyond what the financials produce. After all, a stagnating company has a lower valuation. Providing vision and leadership can not only improve the financials but bring the valuation back to life, driving much of the share price appreciation.

(Satya Nadella’s tenure over nine and a half years)

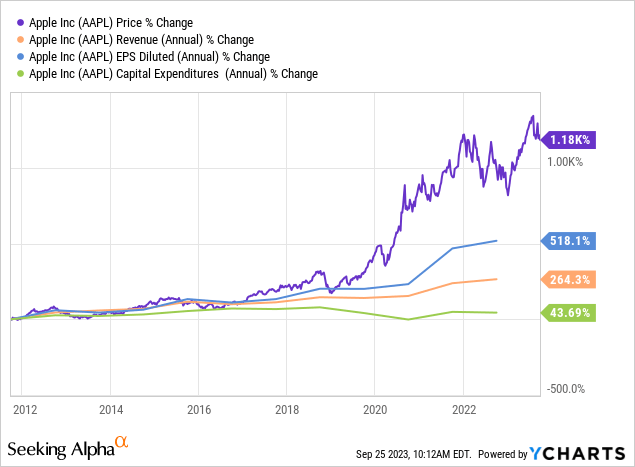

While the share price since Tim Cook’s tenure started in 2011 has done very well for itself, revenue growth has stagnated, and capital expenditures have decreased since 2019 and have only grown 44% since 2011.

Some might argue less CapEx and still higher revenue means the company can do more with fewer investments. However, the problem is the reduction in investments affects future growth. And if you take away the pandemic bump, Apple’s growth has been relatively flat since 2019.

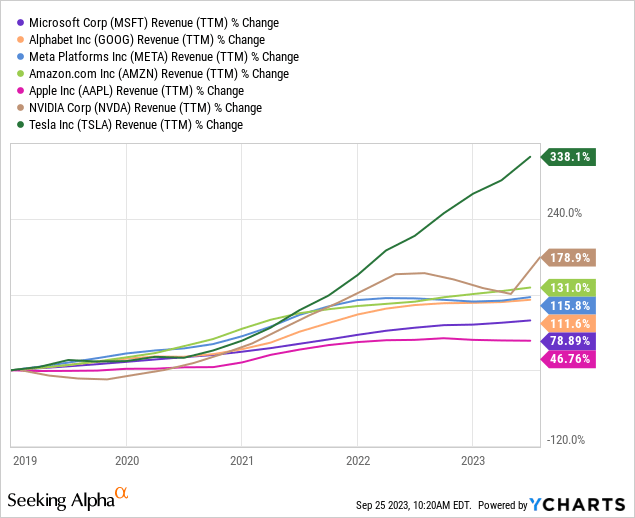

Overall, lower CapEx spend remains, but the spend it is going towards is efforts like a 5G modem with a negative ROI. Decisions like this have led to revenue growth since January 2019 amounting to only 47%. Meanwhile, every other mega-cap stock has outperformed it with ease.

Apple has had its Services group to lean on while its hardware lines have jumped around the zero growth line over the last several years. But Services is reaching the point of flatlining now. A new product line where it’s not a follower (copier) – thus eliminating the VR headset – is needed. Someone with vision able to take Apple from a content-on-its-laurels company like Microsoft was for all of the 2000s to a reborn visionary leader would make Apple worth investing in. Until then, the status quo is going to prevail, and incremental improvements to the iPhone will be the old guard, with investments to in-house its components leading to « I hope we get single-digit growth this quarter » investment cases.

Unable To Get Out Of Its Own Way

For all of its track record and abilities, Apple has not only invested in places where the reward is nil, it’s investing in areas where it throws away billions while its failure helps its would-be competitor’s R&D efforts to put itself in a continual behind-the-8-ball situation. This is nothing more than a business leadership failure. Apple needs to cut bait and pivot to product innovation, a line of products outside of watches and VR headsets already well-researched by competitors.

A management team has run its course when investments go toward low-success, low-reward investments. Building an in-house modem and wireless team is about the worst business decision the market has seen in any mega-cap company in the last decade. The latest supply renewal for three years seals the deal and serves as a wake-up call to leadership and investors. A new CEO needs to come in, cut the fat, and pivot to a vision skating to where the puck is going, not where it is.

Ultimately, a 5G modem may produce a new company, not a copy of a wireless component.

->Google Actualités